Table of Contents

Introduction

Securing a student credit card is a pivotal step in building a solid financial foundation during your college years. Fortunately, the application process is straightforward and can be completed online through the card issuer’s website. Some banks or credit unions may also allow applications via phone or at a local branch.

When applying, be prepared to provide essential personal and financial information, including your full name, date of birth, and income details. A quick decision on your application is possible, with approved applicants typically receiving their cards in the mail within a few weeks. Explore the option of online pre approvals to assess your approval odds before applying.

Maximizing the Benefits of Your Student Credit Card

While a student credit card can help establish credit and foster good financial habits, responsible usage is crucial. Maintain a low balance and ensure timely and full monthly payments to avoid damaging your credit history. Take advantage of the card’s benefits, such as bonus cash back or points in specific spending categories, and track your progress towards any welcome bonus spending requirements.

Additionally, familiarize yourself with the card’s perks, including purchase protection and other insurance benefits that can enhance your overall financial experience.

Consider Student Credit Card Alternatives: A Comprehensive Look

If you’re a college student with limited or no credit history, don’t feel confined to student credit cards. Several options exist that may better suit your needs and financial goals:

1. General Credit Cards:

- Bank-Specific Offers: Some banks, like Chase, offer credit cards that are easier to qualify for if you already have a qualifying checking account with them. The Chase Freedom Rise is one example, often requiring no credit history for approval.

- Cards Designed for No Credit History: Cards like the Petal® 1 “No Annual Fee” Visa® Credit Card specifically cater to individuals with no credit history, making them a viable option for students.

2. Premium Rewards Cards:

If you have a good credit history (or a cosigner with one), don’t overlook premium cash-back or travel rewards cards. These cards often come with:

- Higher Welcome Bonuses: These can jumpstart your rewards earnings.

- Better Rewards Rates: Earn more cash back or points on everyday purchases.

- Valuable Perks: Enjoy benefits like airport lounge access, travel insurance, or purchase protection.

3. Secured Credit Cards:

While they require a security deposit (which acts as your credit limit), secured cards are a good way to build credit from scratch. However, keep these factors in mind:

- Deposit Refund: The deposit is usually refundable once you’ve established good credit behavior, but this can take time.

- Rewards and Benefits: Secured cards typically offer fewer rewards and benefits compared to unsecured cards.

Important Considerations:

- Interest Rates: Student credit cards often have higher interest rates than other cards. If you carry a balance, consider cards with lower rates.

- Fees: Watch out for annual fees, late payment fees, and foreign transaction fees.

- Credit Limit: Start with a lower credit limit to avoid overspending and accumulating debt.

Remember, the best credit card for you depends on your individual circumstances and financial goals. Research and compare different options before making a decision.

International Student Eligibility

International students can also access student credit cards, provided they have a Social Security number or Individual Taxpayer Identification Number. Options for international students may include the Petal® 1 “No Annual Fee” Visa® Credit Card, Capital One SavorOne Student Cash Rewards Credit Card, and Capital One Quicksilver Student Cash Rewards Credit Card.

Our Comprehensive Evaluation Methodology for Student Credit Cards: A Deep Dive

Our team of financial experts and data analysts meticulously scrutinized over two dozen credit cards specifically designed for students or individuals with limited credit history. We employed a rigorous evaluation process, considering a wide range of factors to determine our star ratings (out of five):

Key Evaluation Criteria:

- Pricing and Fees: We carefully analyzed interest rates (APRs), annual fees, late payment fees, foreign transaction fees, and balance transfer fees. Lower APRs and minimal fees were prioritized.

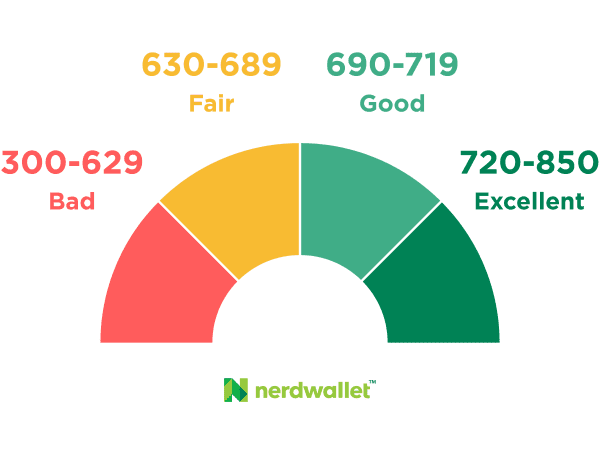

- Credit Threshold: We assessed the credit score requirements for each card, favoring those accessible to students with limited or fair credit.

- Rewards Value: We thoroughly examined the rewards programs, including cash back percentages, points systems, redemption options, and bonus categories. Cards with higher overall rewards value received higher ratings.

- Welcome Bonus Value: We evaluated the size and attainability of welcome bonuses, factoring in spending requirements and timeframes. Generous and easily achievable bonuses were valued.

- Benefits: We considered additional perks such as travel insurance, purchase protection, extended warranties, and cell phone protection. Cards with valuable benefits were given preference.

- Annual Credits: We assessed any annual statement credits for travel, dining, or other expenses, recognizing their potential to offset costs and enhance value.

Prioritization:

Our evaluation methodology emphasized the following aspects:

- Low APRs: Cards with lower interest rates were favored to minimize interest charges for users who carry balances.

- No Foreign Transaction Fees: Cards without these fees were preferred for students who may travel or study abroad.

- No Annual Fees: Cards with no annual fees were prioritized to maximize value and affordability for students.

- Accessibility: We emphasized cards with lower credit score requirements, ensuring options for students with limited credit history.

Our Commitment:

Our aim is to provide transparent and comprehensive evaluations to help students make informed decisions about credit cards. By carefully weighing the factors mentioned above, we strive to identify the best options available in the market.

We encourage students to consider their individual needs and financial goals when choosing a credit card. Our evaluations serve as a valuable resource to guide them through this process.

Unlocking Financial Freedom: Top Student Credit Cards for You in 2024

Building credit as a student sets a strong foundation for your financial future. But with a vast array of student credit cards, choosing the right one can be overwhelming. Don’t worry, this guide will equip you to navigate the options and discover the perfect card to match your needs!

Why Use a Student Credit Card?

Student credit cards offer a gateway to building a healthy credit score, essential for securing loans, renting apartments, and even qualifying for better insurance rates. Responsible credit card use demonstrates your ability to manage debt and opens doors to future financial opportunities.

Choosing the Right Student Credit Card

Not all student credit cards are created equal. Each card comes with its own unique set of features and benefits. To find the best card for your needs, it’s crucial to carefully consider several key factors:

Rewards Programs

One of the most enticing aspects of student credit cards is the potential to earn rewards. Different cards offer different types of rewards, such as:

- Cash Back: Earn a percentage of your spending back as cash, which can be redeemed for statement credits or deposited into your bank account.

- Travel Rewards: Accumulate points or miles that can be used for flights, hotels, and other travel expenses.

- Points: Earn points that can be redeemed for merchandise, gift cards, or other rewards.

To choose the best rewards program for you, think about your spending habits and what type of rewards you would value most.

Annual Fees

Some student credit cards charge an annual fee, while others do not. If a card has an annual fee, it’s important to weigh the cost against the rewards offered.

Ask yourself:

- Are the rewards valuable enough to offset the annual fee?

- Could I find a comparable card without an annual fee?

Interest Rates

Student credit cards typically have higher interest rates than traditional credit cards. This means that if you carry a balance from month to month, you’ll accrue interest charges, making it more expensive to pay off your debt.

To avoid high-interest charges:

- Make it a priority to pay your balance in full each month.

- If you can’t pay in full, pay as much as you can to minimize interest charges.

Credit Requirements

Before applying for a student credit card, check the credit requirements. Some cards are specifically designed for students with no credit history, while others may require a good credit score.

If you have limited or no credit history, look for cards that cater to students in your situation. These cards often have less stringent requirements and can help you build credit responsibly.

By carefully evaluating these factors, you can find the best student credit card to suit your financial needs and goals. Remember, the right card can be a valuable tool for building credit and earning rewards while you’re in school.

Additional Factors to Consider:

Beyond the key factors mentioned above, there are a few additional things to keep in mind when choosing a student credit card:

- Sign-Up Bonuses: Some cards offer attractive sign-up bonuses, such as bonus cash back or points, for spending a certain amount within the first few months of opening the account. These bonuses can be a great way to jumpstart your rewards earnings.

- Introductory APR Offers: Certain cards may offer a 0% introductory APR on purchases or balance transfers for a limited time. This can be helpful if you anticipate carrying a balance or transferring debt from another card. However, be sure to understand the terms and the regular APR that will apply after the introductory period ends.

- Perks and Benefits: Some student credit cards come with additional perks and benefits, such as purchase protection, extended warranties, travel insurance, or access to exclusive events. Consider whether these perks align with your lifestyle and spending habits.

- Customer Service: Research the card issuer’s customer service reputation. You want to choose a company that offers reliable and accessible customer support in case you have questions or encounter any issues with your card.

Taking the Next Steps:

Once you’ve carefully considered all these factors, it’s time to start comparing different student credit cards. Many online resources, such as NerdWallet, Forbes Advisor, and Bankrate, provide comprehensive reviews and comparisons of student credit cards. You can also visit the websites of individual card issuers to learn more about their specific offerings.

Remember, building good credit is a marathon, not a sprint. By choosing the right student credit card and using it responsibly, you can establish a solid financial foundation for your future.

Top Student Credit Card Options

Based on popular features and benefits, here are some of the best student credit cards to consider:

- Discover it® Student Cash Back: Renowned for its rotating bonus categories, this card offers cash back on everyday purchases like groceries and gas. Plus, it automatically matches all the cash back you earn at the end of your first year!

- Capital One SavorOne Student Cash Rewards Credit Card: Foodies, rejoice! This card offers cash back rewards on dining and entertainment expenses, perfect for students who enjoy eating out and exploring.

- Capital One Quicksilver Student Cash Rewards Credit Card: This card offers a straightforward flat-rate cash back on all purchases, making it a great choice for students with varied spending habits.

- Bank of America® Travel Rewards credit card for Students: For the travel enthusiast, this card rewards you with points for travel purchases and everyday spending. Redeem points for flights, hotels, and other travel experiences.

- Deserve EDU: This card boasts a unique feature – it reports to all three major credit bureaus (Experian, Equifax, and TransUnion) from the very first statement, accelerating your credit-building journey.

Building a Bright Financial Future: The Power of Responsible Credit Card Use

Your student credit card is more than just a tool for purchases; it’s a key to unlocking a world of financial opportunities. By embracing responsible credit habits now, you’re laying the foundation for a brighter financial future:

Building a Strong Credit History:

- Timely Payments: Consistently paying your credit card bills on time is the single most important factor in establishing good credit. It demonstrates your reliability and financial responsibility to lenders.

- Low Credit Utilization: Keeping your credit utilization ratio (the amount of credit you use compared to your credit limit) low shows that you’re not overextending yourself financially.

- Length of Credit History: The longer you maintain responsible credit card use, the stronger your credit history becomes, which can benefit you in the long run.

Financial Success:

- Access to Loans and Credit: A good credit history opens doors to various financial products and services, such as mortgages, auto loans, and personal loans, often at more favorable interest rates.

- Lower Insurance Premiums: Many insurance companies consider credit scores when determining premiums. A good credit score can translate to lower insurance costs.

- Better Rental Opportunities: Landlords often check credit reports when evaluating potential tenants. A strong credit history can improve your chances of getting approved for your dream apartment.

- Career Advancement: Some employers may check credit reports as part of background checks. A good credit history can reflect positively on your financial responsibility and professionalism.

Countless Opportunities:

- Financial Independence: Responsible credit card use can help you achieve financial independence sooner by avoiding debt and building wealth.

- Travel and Experiences: A good credit score can unlock travel rewards and benefits, allowing you to explore the world and create lasting memories.

- Investments and Savings: With a solid credit history, you can access investment opportunities and secure better interest rates on savings accounts.

- Peace of Mind: Knowing you have a strong financial foundation can reduce stress and provide peace of mind as you navigate life’s challenges.

Additional Tips for Responsible Credit Card Use:

- Only spend what you can afford to repay in full each month.

- Avoid carrying a balance to escape high interest charges.

- Monitor your credit report regularly for errors and dispute them if necessary.

With the right student credit card and responsible financial habits, you’ll be well on your way to achieving your financial goals!