Table of Contents

Embarking on your financial journey can feel daunting, but with the right tools and knowledge, you can achieve financial independence. A budget planner, designed specifically for beginners, is your key to unlocking a world of financial possibilities.

What is a Budget Planner and Why Do Beginners Need It?

A budget planner is your personalized financial roadmap, guiding you towards your monetary goals. It’s a simple yet powerful tool that empowers you to track your income, categorize expenses, and allocate funds for savings and future aspirations. For beginners, a budget planner simplifies the budgeting process, providing structure and clarity as you navigate your financial landscape.

Key Benefits of Using a Budget Planner for Beginners

Gain Control Over Your Finances: Take charge of your money and make informed decisions about spending and saving.

Reduce Financial Stress: Eliminate the worry of overspending or living paycheck to paycheck.

Achieve Financial Goals: Whether saving for a down payment, a dream vacation, or retirement, a budget planner helps you stay on track.

Build Healthy Financial Habits: Develop responsible spending patterns and make saving a priority.

Choosing the Right Budget Planner for beginners

There’s no one-size-fits-all budget planner. Choose one that aligns with your lifestyle and preferences. Options include:

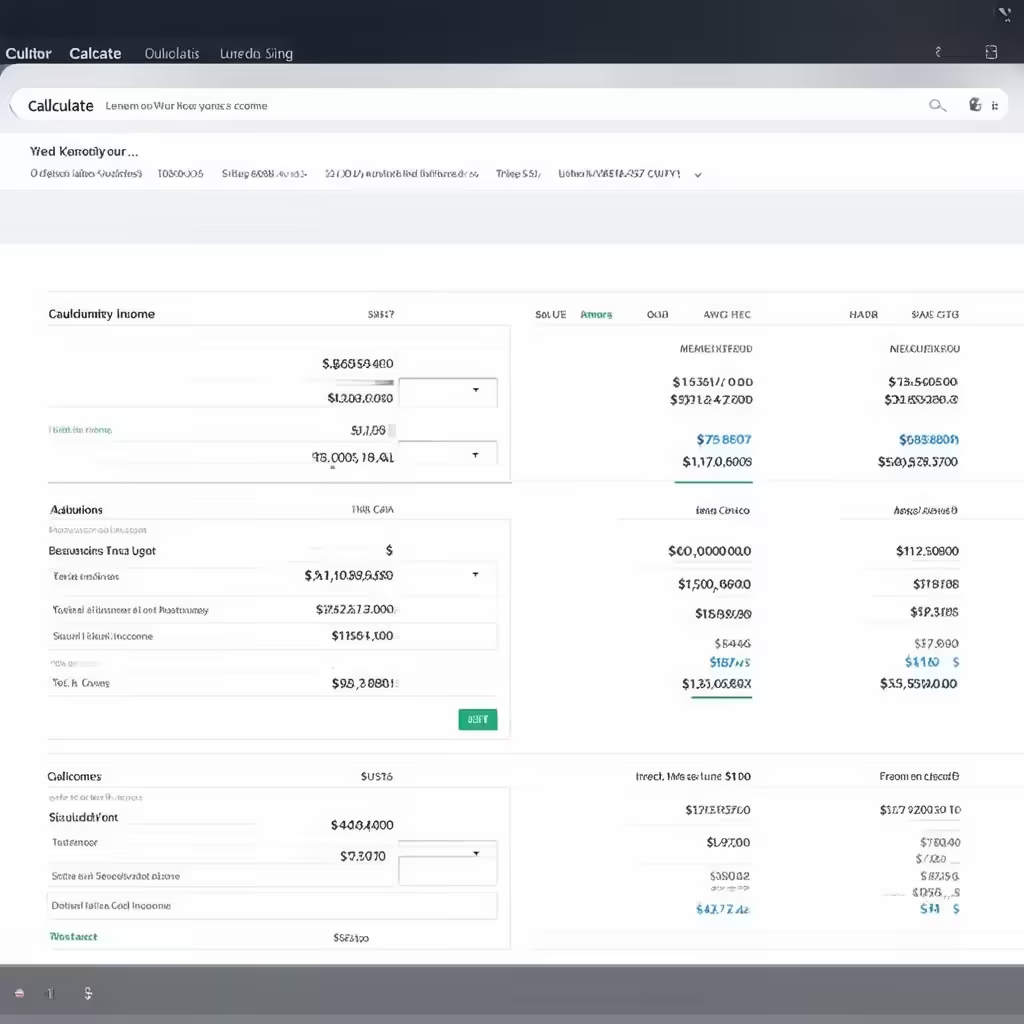

Digital Apps: User-friendly apps with features like expense tracking, bill reminders, and financial goal setting.

Spreadsheets: Customizable templates that allow you to tailor your budget to your specific needs.

Pen and Paper: Traditional method for those who prefer a hands-on approach.

Essential Steps for Creating Your Budget Plan

Calculate Your Income: Determine your total monthly take-home pay from all sources.

Track Your Expenses: Record every expense, categorizing them as fixed (rent, utilities) or variable (groceries, entertainment).

Set Spending Limits: Allocate a specific amount to each expense category based on your income and priorities.

Prioritize Savings: Set aside a portion of your income for savings goals, emergency funds, and future investments.

Review and Adjust Regularly: Monitor your spending, compare it to your budget, and make necessary adjustments to stay on track.

Remember, consistency is key. Regularly reviewing and updating your budget planner will ensure it remains a valuable tool on your path to financial success.

Additional Tips for Budget Planner for beginners

Set SMART Goals: Specific, measurable, achievable, relevant, and time-bound goals keep you motivated.

Be Realistic: Start with small, achievable goals and gradually increase them over time.

Celebrate Wins: Acknowledge your progress and reward yourself for sticking to your budget.

Seek Support: Share your budgeting journey with a friend, family member, or financial advisor for encouragement and accountability.

By embracing the power of a budget planner, you’re taking the first step towards a brighter financial future. Remember, everyone starts as a beginner. With dedication and the right tools, you can achieve financial freedom and create a life of abundance.