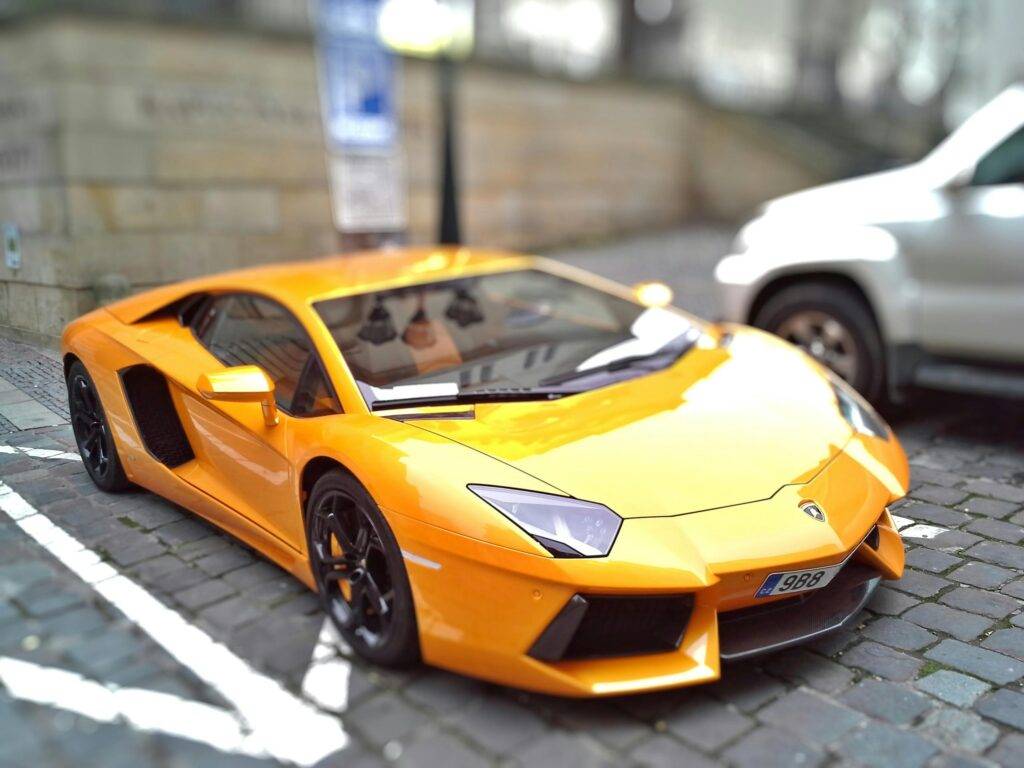

Owning a classic car is a unique experience, blending the thrill of driving a piece of automotive history with the responsibility of preserving it. Just like any vehicle, classic cars need insurance, but navigating the world of classic car insurance requires specific knowledge. Let’s delve into what makes insuring your cherished classic different and how to find the right coverage.

Table of Contents

Why Classic Car Insurance is Unique:

Unlike standard auto insurance, classic car insurance recognizes the distinct nature of these vehicles. Here’s what sets it apart:

- Agreed Value Coverage: Standard policies pay out the “actual cash value” in case of a total loss, which depreciates over time. Classic car insurance often uses “agreed value,” meaning you and the insurer agree on the car’s worth upfront, ensuring a fair payout if the worst happens.

- Usage Limitations: Classic car policies often have mileage restrictions, assuming the vehicle isn’t your daily driver. This can result in lower premiums, reflecting the reduced risk.

- Specialized Coverage: Classic car insurance can offer tailored coverage options for spare parts, restoration projects, and even participation in shows and rallies.

- Knowledgeable Insurers: Opt for insurers specializing in classic cars. They understand the nuances of these vehicles, including valuation, repair costs, and the passionate community surrounding them.

- Finding the Right Classic Car Insurance:

- Assess Your Needs: Consider your car’s value, usage, storage, and any modifications. This helps determine the appropriate coverage level and policy type.

- Research Reputable Insurers: Look for companies specializing in classic car insurance with a strong track record and positive customer reviews.

- Compare Quotes: Obtain quotes from multiple insurers to ensure you’re getting the best value for your specific needs.

- Understand Policy Details: Carefully review the policy terms, including coverage limits, deductibles, and any exclusions or restrictions.

- Ask Questions: Don’t hesitate to clarify any doubts with the insurer before committing to a policy.

Delving Deeper into Classic Car Insurance:

Now that we’ve covered the basics, let’s explore some additional aspects of classic car insurance to ensure comprehensive protection for your treasured vehicle:

Factors Influencing Premiums:

Several factors can influence your classic car insurance premiums:

- Vehicle Value: Higher-valued cars naturally command higher premiums due to the increased potential payout in case of a claim.

- Vehicle Age & Rarity: Older or rarer models might require specialized coverage, impacting the premium.

- Driving History: A clean driving record demonstrates responsible ownership and can lead to lower premiums.

- Storage & Security: Secure storage options like garages and alarm systems can lower the risk of theft or damage, potentially reducing premiums.

- Usage & Mileage: Limited mileage and occasional use often translate to lower premiums compared to daily driving.

Additional Coverage Options:

Beyond the standard coverage, consider these options for enhanced protection:

- Spare Parts Coverage: Protects your valuable spare parts from theft or damage.

- Restoration Coverage: Provides coverage during the restoration process, safeguarding your investment.

- Roadside Assistance: Ensures help is available in case of breakdowns or emergencies.

- Agreed Value Plus: Offers an additional buffer on top of the agreed value in case of a total loss.

Choosing the Right Insurer:

- Experience & Expertise: Opt for insurers with a proven track record in classic car insurance. They understand the intricacies of these vehicles and can provide tailored solutions.

- Claims Handling: Research the insurer’s claims process and reputation for fair and efficient handling.

- Customer Service: Choose an insurer known for responsive and helpful customer service.

- Financial Stability: Ensure the insurer has strong financial standing to guarantee they can fulfill their obligations in case of a claim.

Choosing the Right Insurer:

Engaging with the classic car community can provide valuable insights and support

- Classic Car Clubs: Joining a club connects you with fellow enthusiasts and offers access to resources and knowledge.

- Online Forums & Groups: Online platforms provide a space to discuss classic car ownership, insurance, and maintenance.

- Classic Car Shows & Events: Attending events allows you to connect with experts and learn more about protecting your vehicle.

- Protecting your classic car goes beyond regular maintenance; it requires the right insurance coverage. By understanding the unique aspects of classic car insurance and choosing a policy tailored to your needs, you can ensure your prized possession remains protected for years to come.