Coverage and Saving Money For many drivers, car insurance can feel like a complex and confusing web of terms, policies, and exclusions. Navigating this landscape can be daunting, especially for new drivers or those unfamiliar with the intricacies of insurance coverage. This comprehensive guide aims to demystify car insurance, providing you with the knowledge and tools to understand your coverage, make informed decisions, and potentially save money on your premiums.

Understanding the Basics of Car Insurance on Coverage and Saving

Car insurance coverage and saving is a contract between you and an insurance company. In exchange for a monthly premium, the insurance company agrees to financially protect you in the event of an accident or other covered incident. The specific coverage provided by your policy will depend on the type of policy you choose and the limits you select.

Types of Car Insurance Coverage and Saving

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. It covers bodily injury and property damage caused to others if you are at fault in an accident.

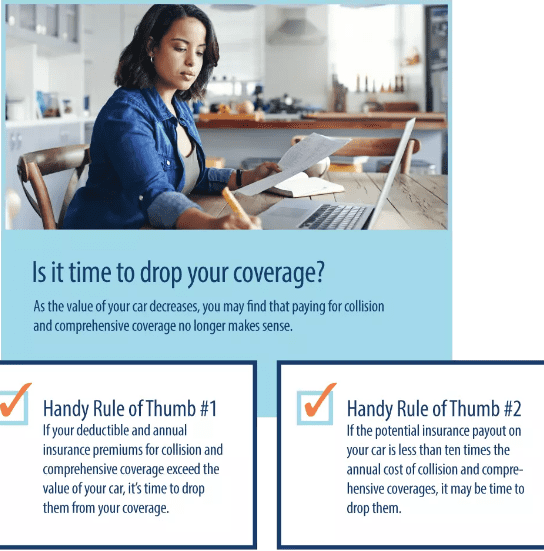

- Collision Coverage: This covers damage to your own vehicle caused by a collision with another object, such as another car, a tree, or a fence.

- Comprehensive Coverage: This covers damage to your own vehicle caused by events other than a collision, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This covers you if you are injured in an accident caused by a driver who does not have insurance or does not have enough insurance to cover your damages.

Factors that Affect Your Car Insurance Premium:

- Your driving record: Drivers with clean driving records typically pay lower premiums.

- Your age and gender: Younger drivers and males tend to pay higher premiums.

- Your vehicle: The make, model, and year of your car can affect your premium.

- Your location: Premiums are typically higher in urban areas than in rural areas.

- Your deductible: Choosing a higher deductible can lower your premium, but you will be responsible for more out-of-pocket costs in case of a claim.

- Your coverage level: The more coverage you choose, the higher your premium will be.

Tips for Saving Money on Car Insurance:

Shop around and compare quotes from multiple insurance companies.

Ask about discounts. Many insurance companies offer discounts for things like good driving records, multiple vehicles, and being a member of certain organizations.

Consider raising your deductible. As mentioned earlier, a higher deductible can lead to lower premiums.

Bundle your car insurance with other insurance policies, such as home or renters insurance.

Pay your premium in full instead of monthly installments. Some insurance companies offer discounts for paying your premium in full.

Maintain a clean driving record. Avoiding accidents and traffic violations can help you qualify for lower rates.

Consider dropping optional coverage that you don’t need. For example, if your car is older and has low value, you may not need comprehensive coverage.

Additional Resources:

- Your state’s Department of Insurance website: This website will provide you with information about car insurance requirements in your state.

- The National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that provides information and resources about car insurance.

- Consumer Reports: Consumer Reports provides unbiased reviews of car insurance companies and can help you compare different policies.

Conclusion

Understanding car insurance and making informed decisions about your coverage can help you save money and protect yourself financially in the event of an accident. By following the tips outlined in this guide, you can demystify car insurance and make the most of your insurance policy. Remember to shop around, compare quotes, ask about discounts, and consider your individual needs and circumstances when choosing a car insurance policy.