Introduction

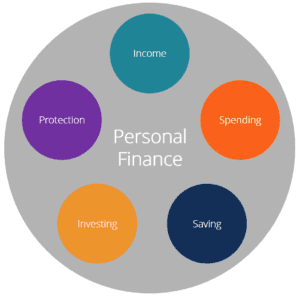

In the realm of personal finance, the age-old dilemma of deciding between savings and investments continues to perplex individuals seeking to secure their financial future. While both options offer distinct advantages, understanding the nuances of each can empower you to make informed decisions that align with your financial goals. This article delves into the key differences between savings and investments, helping you navigate the path to financial success.

Savings: A Safety Net

Savings serve as a foundational component of any well-rounded financial plan. This liquid pool of funds acts as a safety net, providing you with readily accessible money for emergencies, unexpected expenses, or short-term goals. Traditional savings vehicles, such as savings accounts and certificates of deposit (CDs), offer minimal risk and are insured up to a certain limit by the Federal Deposit Insurance Corporation (FDIC) in the United States, ensuring your principal remains secure.

However, the trade-off for this security is that savings generally yield lower returns compared to investments. Savings accounts often have relatively low interest rates, which might not even keep pace with inflation. This means that while your money is safe, it may not grow substantially over time.

Investments: Cultivating Wealth

Investments, on the other hand, have the potential to grow your wealth at a faster rate. Whether it’s stocks, bonds, mutual funds, real estate, or other assets, investments can generate returns that outpace inflation, thus increasing your purchasing power over time. Unlike savings, investments tend to come with more risk, as their value can fluctuate with market conditions.

Diversification is a crucial strategy when it comes to investing. Spreading your investments across different asset classes can help mitigate risk. While the potential for higher returns is attractive, it’s important to remember that investments also come with the risk of loss. Market volatility can lead to short-term fluctuations, but historically, well-diversified portfolios have shown resilience and growth over the long term.

Finding the Balance: Your Financial Goals

The decision between savings and investments ultimately depends on your financial goals and risk tolerance. If you’re aiming to build an emergency fund, save for a vacation, or create a cushion for unforeseen expenses, a dedicated savings account is a prudent choice. It ensures that your money is readily available when needed, without the worry of market volatility affecting its value.

Conversely, if your objectives involve long-term wealth accumulation, such as retirement planning or funding your children’s education, investments could play a pivotal role. Starting early and allowing your investments to compound over time can result in significant growth.

Striking the right balance between savings and investments is often the key. Many financial advisors recommend establishing an emergency fund equal to three to six months’ worth of living expenses before delving into more aggressive investment strategies. This approach provides a safety net while enabling you to harness the potential growth of investments for future financial milestones.

Conclusion

In the eternal debate of savings versus investments, there’s no definitive answer—it all hinges on your individual circumstances, goals, and risk tolerance. A holistic financial approach could involve both components working together in harmony. While savings offer security and liquidity, investments have the power to grow your wealth over time.

Ultimately, the choice comes down to finding the equilibrium that aligns with your short-term needs and long-term aspirations. By understanding the merits of both savings and investments, you can navigate the financial landscape with confidence, making choices that propel you towards a prosperous future.