The Financial Wellness Revolution: Where Money Meets Mindfulness

Finance-related health issues have become increasingly obvious. Research conducted this year shows that financial pressure affects more than sixty percent of young adults while women and minorities bear the burden to a greater extent. People are undergoing a revolution because they use intentional financial habits to revolutionize their budgeting and saving and spending processes.

Previous times dictated that financial triumph equated to wealth accumulation. During the present day Millennials alongside members from Gen Z group consider financial wellness essential for their overall self-care practice. People now regard money as more than an acquisition tool because it enables them to establish both financial security and mental tranquility and emotional peace.

Mindful money habits involve bringing awareness, intention, and compassion to your financial decisions. Rather than following rigid budgeting rules that often lead to guilt and anxiety, this approach focuses on aligning your spending with your values while acknowledging the emotional aspects of your relationship with money. It’s about creating balance between planning for tomorrow and living well today.

Understanding the Money-Mind Connection

Before diving into specific mindful budgeting techniques, it’s important to understand the profound connection between financial health and mental wellness. Research consistently shows that financial stress can trigger or worsen anxiety, depression, and even physical health problems. Conversely, poor mental health can lead to financial difficulties through impulsive spending, avoidance behaviors, or inability to focus on financial planning.

The American Psychological Association reports that money remains the top source of stress for many Americans, with 72% of people feeling stressed about finances. This stress doesn’t just affect our mood—it impacts our sleep, relationships, work performance, and overall quality of life.

Financial wellness practices can break this cycle. When you incorporate mindfulness into your money management, you create space between financial triggers and your responses. You become more aware of your spending patterns, less reactive to financial setbacks, and more intentional about how you use your resources. This awareness is the foundation for both better financial decisions and improved mental health.

The Psychology Behind Emotional Spending

Emotional spending—shopping in response to feelings rather than necessity—is a common challenge that mindful money habits can help address. Understanding the psychology behind this behavior is the first step toward changing it.

When we experience negative emotions like stress, sadness, or boredom, the brain looks for quick relief. Shopping provides a temporary dopamine boost, creating a fleeting sense of happiness or control. This explains why 49% of Americans admit to making impulse purchases when feeling down, and why many describe shopping as “retail therapy.”

The problem isn’t the occasional splurge—it’s when emotional spending becomes a primary coping mechanism, leading to financial strain that ultimately worsens the very emotions you were trying to relieve. This cycle can be particularly challenging for those already dealing with anxiety or depression, which affects approximately 40 million U.S. adults.

Signs that emotional spending might be affecting your financial wellness include:

- Feeling regret or guilt after shopping

- Hiding purchases from others

- Shopping when you’re upset, stressed, or bored

- Buying items you don’t need or rarely use

- Struggling to stay within your budget due to unplanned purchases

Breaking this cycle requires developing awareness of your emotional triggers and creating healthier responses. Mindful budgeting techniques help you recognize your spending patterns and create systems that support better choices, even when emotions are running high.

Core Principles of Mindful Money Habits

Mindful money habits are built on several key principles that distinguish them from traditional budgeting approaches:

1. Awareness Without Judgment

The foundation of mindful money management is becoming aware of your financial behaviors without harsh self-criticism. Just as mindfulness meditation involves observing thoughts without judgment, financial mindfulness means noticing your spending patterns, income fluctuations, and emotional reactions to money without labeling them as “good” or “bad.”

This non-judgmental awareness creates a safe space to examine your relationship with money honestly. Instead of thinking, “I’m terrible with money,” you might observe, “I notice I tend to overspend when I’m stressed at work.” This subtle shift reduces shame and opens the door to positive change.

2. Values-Based Decision Making

Mindful budgeting aligns your spending with your personal values. Rather than following arbitrary rules about what you “should” do with your money, this approach encourages you to clarify what truly matters to you and direct your resources accordingly.

For example, if community and experiences are important values, you might prioritize spending on social activities and travel while cutting back in areas that don’t reflect these priorities. This alignment creates a greater sense of satisfaction and reduces the feeling that budgeting is restrictive.

3. Present-Moment Awareness

While financial planning necessarily involves thinking about the future, mindful money habits emphasize awareness of the present moment. This includes being fully present during financial decisions, whether you’re making a purchase, reviewing your accounts, or discussing money with a partner.

Present-moment awareness helps interrupt automatic spending patterns and creates space for more intentional choices. It also allows you to enjoy what you have now rather than always focusing on what’s next, reducing the “hedonic treadmill” effect where we quickly adapt to new purchases and need more to maintain the same level of happiness.

4. Self-Compassion in Financial Setbacks

Financial setbacks are inevitable, whether they’re unexpected expenses, income reductions, or spending mistakes. Mindful money management incorporates self-compassion—treating yourself with the same kindness you would offer a good friend who’s struggling.

Self-compassion doesn’t mean excusing harmful financial behaviors; rather, it means acknowledging difficulties without harsh self-criticism and maintaining perspective during challenges. This approach reduces financial anxiety and makes it easier to recover from setbacks without abandoning your overall goals.

5. Integration with Overall Wellness

Perhaps the most distinctive aspect of mindful money habits is their integration with other aspects of wellness. Rather than viewing financial health as separate from emotional, physical, and social well-being, this approach recognizes the interconnections.

For example, reducing financial stress can improve sleep quality, which enhances physical health and emotional resilience, which in turn supports better financial decision-making. This holistic perspective transforms budgeting from a tedious chore into an act of self-care.

Practical Mindful Budgeting Techniques

With these principles as our foundation, let’s explore practical techniques for implementing mindful money habits in your daily life:

The Mindful Budget Review

Unlike traditional budgeting that focuses solely on numbers, a mindful budget review incorporates emotional awareness. Set aside 30-60 minutes each week in a calm environment—perhaps with tea or coffee and soft music—to review your finances without distractions.

During this time:

- Check your account balances and recent transactions

- Note any transactions that trigger emotional responses (positive or negative)

- Review progress toward financial goals

- Plan for upcoming expenses and adjustments

The key difference is the addition of emotional awareness. When you notice a transaction that triggers feelings of guilt, anxiety, or even pride, pause to explore that reaction. What does it tell you about your values and priorities? Over time, these observations will reveal patterns that can guide better financial decisions.

Recent research shows that regular financial check-ins can reduce financial anxiety by 28% and improve decision-making. But consistency is crucial—Intuit’s survey found that 58% of 18-35-year-olds who integrated financial management into their weekly routine reported improved quality of life.

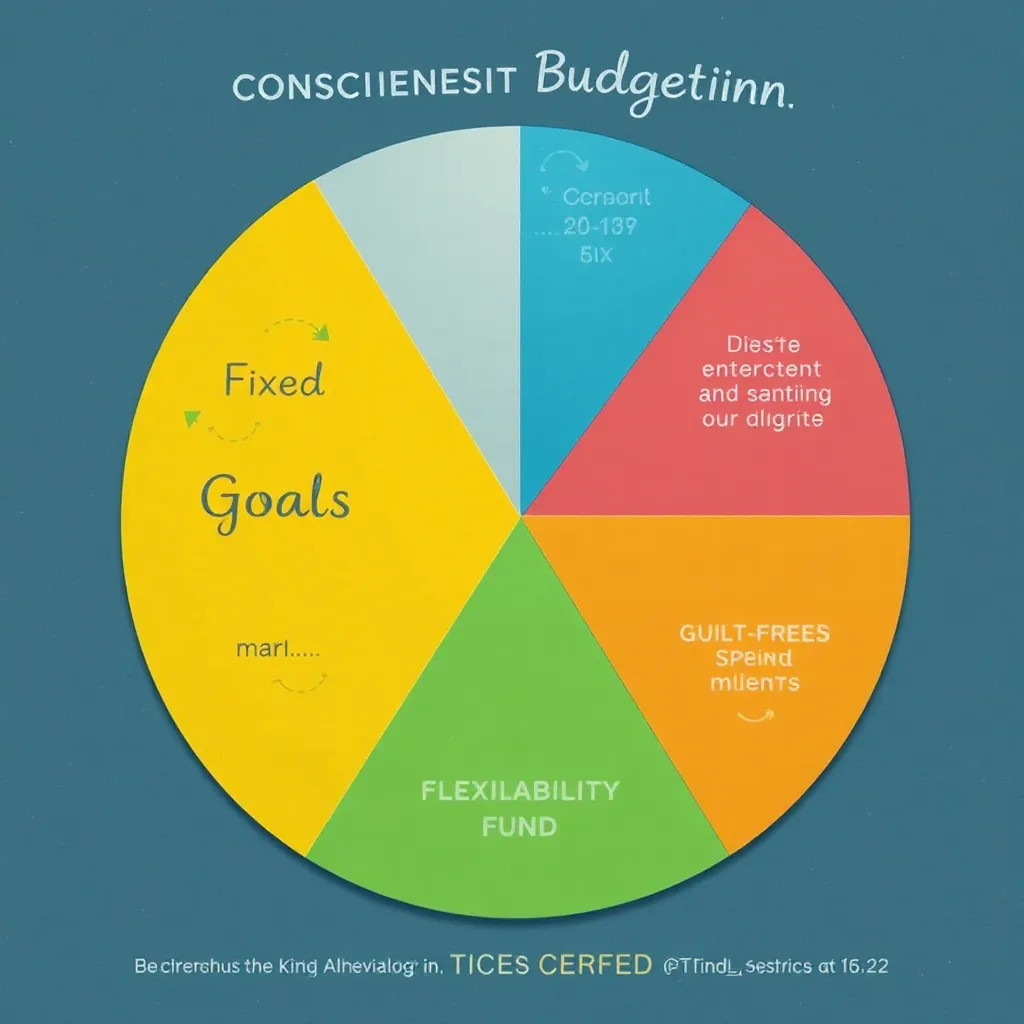

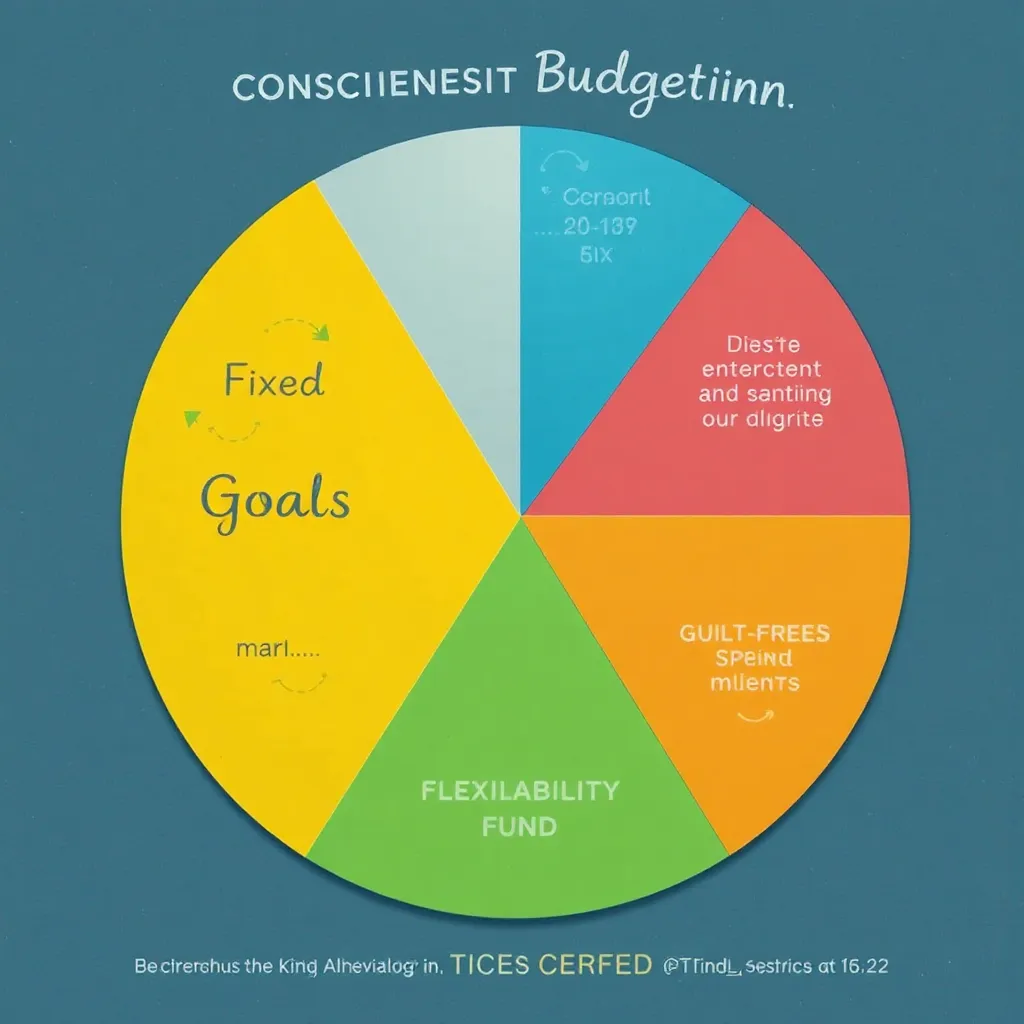

Values-Based Spending Categories

Traditional budgeting typically organizes expenses into standard categories like housing, transportation, and food. While useful for tracking, these categories don’t reflect what expenses actually mean to you personally.

A mindful approach creates personalized categories based on your values. For example:

- “Connection” might include dining out with friends, gifts, and family activities

- “Growth” could cover education, books, and experiences that expand your horizons

- “Wellbeing” might encompass exercise, healthy food, and mental health support

The spending limits for each category should reflect both financial reality and your personal priorities. This framework transforms budgeting from a restrictive exercise into an expression of your values. According to recent studies, 44% of people who align spending with personal values report enhanced financial peace of mind.

The Pause Practice

Impulse spending often happens when there’s no space between desire and purchase. The pause practice—a cornerstone of mindful money habits—creates that crucial space.

For online shopping, implement a 24-hour rule for non-essential purchases. Add items to your cart, then wait a full day before completing the purchase. You’ll often find the initial urgency fades, allowing for a more rational decision.

For in-person shopping, practice physically stepping away from potential purchases for at least five minutes. Use this time to ask yourself:

- Why am I buying this?

- How will it add value to my life?

- Is this aligned with my financial goals and personal values?

This simple practice can dramatically reduce impulse purchases while ensuring that your spending remains intentional. Researchers find that implementing a pause can reduce impulse buying by up to 40% in most consumers.

Mindful Automation

Automation is a powerful tool in financial management, but it’s often approached mechanically. Mindful automation brings awareness and intention to this process.

Start by identifying your most important financial goals—perhaps building emergency savings, paying down debt, or investing for retirement. Set up automatic transfers for these priorities immediately after receiving income, ensuring they happen before discretionary spending.

The mindful aspect comes from regularly reviewing these automations to ensure they still align with your priorities and circumstances. Rather than “set and forget,” approach automation as a dynamic tool that requires periodic adjustment.

This approach combines the psychological benefit of automation (reducing decision fatigue) with the awareness central to mindful money habits. Studies show that those who automate their savings typically save twice as much as those who don’t, while experiencing less financial stress.

Conscious Cash Method

Despite the prevalence of digital payments, cash can be a powerful tool for mindful spending. The physical nature of cash creates a more tangible connection to your money and a natural pause before purchases.

The conscious cash method involves using cash for categories where you tend to overspend. At the beginning of each week or month, withdraw the allocated amount and keep it in a designated envelope or wallet section. When it’s gone, spending in that category stops until the next period.

This method combines the psychological benefits of cash (studies show people typically spend 12-18% less when using physical currency) with mindfulness about spending limits. It’s particularly effective for discretionary categories like dining out, entertainment, or personal shopping.

While not practical for all expenses in today’s digital world, selectively using cash for certain categories can significantly enhance your awareness of spending. About 36% of people who adopt this mixed approach report feeling more connected to their financial decisions.

Mindful Consumption Practices

Mindful money habits extend beyond budgeting to encompass your overall relationship with consumption. Adopting mindful consumption practices can reduce unnecessary spending while increasing satisfaction with what you do purchase.

Key practices include:

- Quality over quantity: Invest in fewer, better-quality items that last longer and provide more satisfaction.

- Intentional shopping environments: Be aware of how shopping environments (both online and physical) influence your decisions, and create boundaries accordingly.

- Gratitude for what you have: Regularly practice appreciation for possessions you already own, reducing the desire for new acquisitions.

- Mindful maintenance: Care for your belongings to extend their life and deepen your appreciation for them.

These practices naturally reduce expenditure while increasing the joy derived from your possessions. Research indicates that individuals who practice mindful consumption not only spend less but report 23% higher satisfaction with their purchases.

Financial Journaling

Writing about your experiences with money can be a powerful tool for developing mindful money habits. Financial journaling creates space to process emotions, identify patterns, and celebrate progress in your relationship with money.

An effective financial journal might include:

- Reflections on significant financial decisions

- Observations about emotional triggers for spending or saving

- Notes on what financial security and freedom mean to you personally

- Documentation of progress toward financial goals

- Gratitude for financial resources and opportunities

Studies show that regular journaling can reduce financial anxiety by helping process complex emotions and clarify goals. For maximum benefit, set aside 10-15 minutes several times per week to write without editing or judgment. The insights gained often reveal patterns that aren’t obvious from reviewing transactions alone.

The Financial Self-Check

Beyond tracking numbers, a mindful approach to money includes regular assessment of your financial wellness on emotional and psychological levels.

Every month, take time to ask yourself:

- How does my current financial situation make me feel?

- What money worries are taking up mental space?

- Where am I making progress that I can acknowledge and celebrate?

- What financial habits or decisions align with my values?

- What small adjustments would increase my financial peace of mind?

This practice bridges the gap between objective financial metrics and subjective well-being. It helps identify areas where small changes could have significant emotional benefits, even when the financial impact might be modest.

According to recent studies, people who regularly assess their financial wellness report 31% lower financial stress levels and make more consistent progress toward their goals.

Building a Personalized Financial Self-Care Routine

Creating a sustainable financial self-care routine requires more than implementing isolated techniques—it means developing a cohesive approach that works with your unique circumstances and psychology. Here’s how to build your own routine:

Assess Your Current Relationship with Money

Before implementing new habits, take time to understand your existing patterns and attitudes toward money. Consider:

- What money messages did you receive growing up?

- What emotions typically arise when you think about finances?

- Where do you feel confident with money, and where do you struggle?

- How do financial concerns impact your overall well-being?

This assessment provides a starting point for identifying which mindful money practices will be most beneficial for you personally. For example, if financial anxiety prevents you from reviewing your accounts, starting with short, structured check-ins might be more helpful than detailed tracking.

Start Small and Build Gradually

Attempting to overhaul your entire financial system at once typically leads to overwhelm and abandonment of new habits. Instead, choose one or two mindful money practices to implement initially, focusing on areas where you experience the most stress or difficulty.

For example, if emotional spending is your primary challenge, begin with the pause practice. If avoidance is your pattern, start with brief weekly check-ins. Once these initial habits feel established—typically after 4-6 weeks of consistent practice—you can add additional elements.

Research shows that this gradual approach leads to much higher long-term adherence rates, with 65% of people maintaining habits introduced incrementally compared to just 20% of those who attempt complete system changes.

Create Environmental Supports

Your physical and digital environments significantly influence your ability to maintain mindful money habits. Set yourself up for success by creating environments that support your intentions.

This might include:

- Designating a specific, pleasant space for financial reviews

- Setting up calendar reminders for regular check-ins

- Using apps that align with your approach to financial mindfulness

- Removing shopping apps from your phone if they trigger impulse spending

- Creating visual reminders of your financial goals and values

These environmental supports reduce the willpower required to maintain new habits. Studies indicate that environmental design can increase habit adherence by up to 300%, making it one of the most powerful tools for sustainable change.

Incorporate Financial Discussions into Relationships

Money remains taboo in many relationships, with 65% of couples reporting significant discomfort discussing finances. Yet financial transparency and communication are crucial for both relationship satisfaction and financial wellness.

Mindful financial communication involves:

- Regular, scheduled conversations about money in non-stressful settings

- Active listening to understand each other’s money histories and values

- Collaborative goal-setting that respects individual priorities

- Shared decision-making processes for major financial choices

These practices reduce financial conflicts and create a supportive framework for maintaining individual mindful money habits. Couples who practice mindful financial communication report 44% fewer money arguments and greater progress toward shared goals.

Track Holistic Metrics

Traditional financial tracking focuses exclusively on numbers—income, expenses, debt, and savings. While these metrics matter, a mindful approach incorporates additional measures of financial wellness.

Consider tracking:

- Your “financial peace” rating on a 1-10 scale each week

- Hours spent worrying about money (with a goal of reduction)

- Alignment between spending and personal values

- Progress toward meaningful financial goals

- Instances of mindful versus automatic financial decisions

These holistic metrics capture the psychological and emotional aspects of financial wellness that pure numbers miss. They allow you to recognize progress in your relationship with money even during periods when numerical progress might be slow.

Schedule Regular Financial Retreats

Beyond weekly check-ins, quarterly or semi-annual “financial retreats” provide opportunities for deeper reflection and planning. These extended sessions—typically 2-4 hours—allow you to step back from day-to-day financial management and consider the bigger picture.

A financial retreat might include:

- Reviewing progress toward long-term goals

- Reassessing whether your financial priorities still align with your values

- Adjusting your systems based on what’s working and what isn’t

- Learning about a financial topic relevant to your current situation

- Celebrating progress and acknowledging challenges

These retreats transform financial planning from a tedious chore into an opportunity for growth and reflection. They also prevent your approach from becoming stale or outdated as your circumstances evolve.

Practice Financial Self-Compassion

Perhaps the most important aspect of financial self-care is self-compassion when facing setbacks or mistakes. Financial perfectionism—the belief that any deviation from your plan represents failure—is a major barrier to long-term progress.

Financial self-compassion includes:

- Acknowledging that everyone makes financial mistakes

- Understanding how past circumstances influenced your financial patterns

- Recognizing that financial setbacks are rarely permanent

- Focusing on the learning opportunity in financial missteps

- Maintaining perspective about the role of money in overall well-being

Research consistently shows that self-compassion leads to better long-term outcomes than harsh self-criticism. People who practice financial self-compassion recover more quickly from setbacks and are 57% more likely to maintain positive financial habits over time.

Mindful Approaches to Common Financial Challenges

Now that we’ve established the foundation of mindful money habits, let’s explore how this approach can help address specific financial challenges:

Managing Debt Mindfully

Debt is a significant source of financial stress for many people, with the average American carrying $96,371 in debt across credit cards, mortgages, student loans, and other obligations. Traditional approaches often focus exclusively on mathematical optimization, but mindful debt management incorporates emotional and psychological factors.

A mindful approach to debt includes:

- Compassionate assessment: Review your debt without shame, understanding the circumstances and choices that led to your current situation.

- Emotional prioritization: While the mathematical approach suggests paying high-interest debt first (which is generally sound), consider the emotional benefit of eliminating smaller debts to build momentum and confidence.

- Sustainable strategies: Create debt repayment plans that are realistic given your current circumstances, rather than unsustainable approaches that look good on paper but lead to burnout.

- Meaningful visualization: Connect debt repayment to your core values and desired future, making the process meaningful rather than punitive.

- Celebration of progress: Acknowledge each step forward, no matter how small, reinforcing the positive aspects of debt reduction.

This mindful approach doesn’t negate the importance of addressing high-interest debt efficiently, but it incorporates psychological factors that significantly impact your ability to maintain debt reduction efforts. Studies show that people who incorporate these elements are 40% more likely to successfully eliminate debt compared to those following purely mathematical approaches.

Mindful Saving and Investing

Saving and investing for the future are essential financial practices, but they can trigger anxiety about uncertainty or deprivation. Mindful approaches make these practices more sustainable by connecting them to present well-being rather than distant goals alone.

Key elements include:

- Value-aligned saving goals: Connect saving to specific values and aspirations rather than abstract targets, making the purpose emotionally resonant.

- Present-moment benefits: Identify how saving actually enhances your current well-being through increased security and reduced stress, not just future benefits.

- Authentic timeline setting: Create realistic timeframes for goals based on your actual circumstances rather than idealized expectations.

- Investment congruence: Ensure your investments align with your values through options like ESG (Environmental, Social, and Governance) funds or community investment.

- Balance awareness: Find your personal balance between present enjoyment and future security, recognizing that extreme positions in either direction reduce overall well-being.

This approach transforms saving from a sacrifice to a meaningful choice. Research indicates that individuals who connect saving to personal values save approximately 25% more while experiencing less psychological resistance to the process.

Navigating Financial Uncertainty

Financial uncertainty—whether from job instability, health concerns, or economic conditions—is a primary trigger for financial anxiety. Mindful money habits provide tools for maintaining equanimity even when the future is unclear.

Strategies include:

- Scenario planning with boundaries: Consider potential futures without spiraling into catastrophizing, using time limits for “worry sessions” to process concerns productively.

- Control identification: Clearly distinguish between aspects of your financial situation you can control and those you cannot, focusing energy on the former.

- Emergency fund mindfulness: View emergency savings as a present-moment tool for peace of mind, not just future protection.

- Flexible planning: Create financial plans with built-in flexibility to adapt to changing circumstances without abandoning your core approach.

- Community connection: Reduce isolation during financial uncertainty by connecting with others facing similar challenges, providing both practical support and emotional reassurance.

These practices don’t eliminate uncertainty, but they reduce its psychological impact. Studies show that individuals who adopt these approaches report 33% lower financial anxiety even when facing significant financial challenges.

Mindful Career and Income Development

Career decisions and income growth are central to financial wellness but often receive less attention in financial planning discussions. A mindful approach to career development integrates financial considerations with broader well-being and personal values.

Key practices include:

- Value-based career assessment: Regularly evaluate how your current work aligns with your values, skills, and financial needs.

- Conscious skill investment: Intentionally develop skills that enhance both your marketability and personal fulfillment.

- Income diversification awareness: Consider secondary income streams that provide both financial security and meaningful engagement.

- Negotiation mindfulness: Approach salary and benefit negotiations with clarity about your worth and needs, reducing anxiety through preparation.

- Work-life financial balance: Make career decisions that consider the complete financial picture, including hidden costs like childcare, commuting, and stress-related health expenses.

This approach recognizes that career choices impact financial wellness beyond the obvious salary figures. People who take this holistic approach report 37% higher job satisfaction and make career moves that better support their overall financial goals.

Mindful Approaches to Major Life Transitions

Major life transitions—whether expected (like retirement) or unexpected (like job loss)—often trigger financial stress and reactive decision-making. Mindful money habits are particularly valuable during these periods of change.

Strategies include:

- Emotional and financial preparation: For anticipated transitions, prepare both practically and emotionally, acknowledging fears and concerns alongside practical planning.

- Values recalibration: During transitions, revisit your core values and how they translate financially in your new circumstances.

- Incremental decision-making: Avoid making multiple major financial decisions simultaneously during periods of transition when emotions run high.

- Transition support systems: Identify specific emotional and practical support needed during financial transitions, from professional advisors to friends who provide perspective.

- Narrative awareness: Pay attention to the stories you tell yourself about financial transitions, reframing catastrophic narratives into more balanced perspectives.

Research shows that individuals who incorporate these approaches during major life transitions make better financial decisions and experience significantly less psychological distress, even when the transitions involve financial challenges.

Digital Tools for Mindful Money Management

Technology, when used intentionally, can significantly enhance your mindful money practice. The right digital tools support awareness, reduce cognitive load, and provide insights that would be difficult to generate manually.

Mindful Selection of Financial Apps

The app marketplace is crowded with financial tools, but not all support a mindful approach to money management. When selecting apps, consider:

- Interface design: Choose apps with calm, clear interfaces that reduce anxiety rather than those that use alarming colors or urgent notifications.

- Holistic metrics: Look for tools that track both numerical and qualitative aspects of financial wellness, not just transactions and balances.

- Customizability: Prioritize apps that allow you to categorize spending according to your personal values rather than imposed categories.

- Privacy practices: Consider how your financial data is used and shared, as privacy concerns can undermine the sense of safety essential to mindful money management.

- Trigger awareness: Avoid apps that incorporate shopping features or advertisements that might trigger impulse spending.

Popular apps that often align well with mindful money principles include You Need A Budget (YNAB), which emphasizes intentional allocation of resources; Mint, which provides comprehensive tracking with customizable categories; and Personal Capital, which offers holistic financial planning tools.

Mindful Automation Tools

Automation reduces the cognitive load of financial management while ensuring consistency. Mindfully implemented automation includes:

- Savings automation: Apps like Digit or Qapital that analyze spending patterns and automatically transfer sustainable amounts to savings.

- Bill management: Services like Prism or Papaya that organize, track, and even negotiate bills, reducing administrative stress.

- Subscription tracking: Tools like Truebill or Bobby that identify and help manage recurring subscriptions, increasing awareness of ongoing commitments.

- Investment automation: Platforms like Betterment or Wealthfront that align investment strategies with your values and risk tolerance while handling technical details.

The key is to review these automations regularly with mindful awareness, ensuring they continue to serve your intentions rather than operating on autopilot indefinitely.

Mindfulness and Financial Learning Apps

Continuous learning is an important aspect of financial wellness, and several apps combine financial education with mindfulness principles:

- Cleo: Combines financial tracking with conversational interfaces and behavioral psychology to promote mindful spending habits.

- Clarity Money: Provides insights into spending patterns while offering tools to align expenses with stated priorities.

- Navi: Focuses on financial education through bite-sized lessons integrated with personal financial tracking.

These tools support the growth mindset essential to financial well-being, helping you develop both practical knowledge and self-awareness around money.

Digital Boundaries for Financial Wellness

While digital tools can enhance mindful money management, technology can also undermine financial wellness through exposure to advertising, social comparison, and frictionless spending. Mindful digital boundaries might include:

- Designated shopping-free devices or browsers

- Scheduled times for financial management to prevent constant checking

- Ad blockers to reduce exposure to targeted advertising

- Social media limitations to minimize financial comparison

- Digital “cool-down” periods before major purchases

These boundaries ensure that technology serves your financial intentions rather than undermining them. Studies show that implementing digital boundaries can reduce impulse purchases by up to 35% for regular online shoppers.

Navigating Social Influences on Financial Wellness

Our financial choices don’t happen in isolation—they’re profoundly influenced by social factors, from cultural messages about money to peer pressure and family expectations. Mindful money habits include awareness of these influences and intentional responses to them.

Mindful Social Comparison

Social comparison—measuring your financial situation against others’—is a primary source of financial anxiety. In the age of social media, where we’re exposed to curated representations of others’ lives, this comparison has intensified.

Mindful approaches to social comparison include:

- Reality recognition: Acknowledge that social media and public perceptions rarely reflect financial reality, as most people share highlights rather than complete pictures.

- Value alignment check: When feeling inadequate about your financial situation, revisit your personal values and whether your current path aligns with them.

- Inspiration without envy: Use others’ financial achievements as information or inspiration rather than triggers for inadequacy.

- Comparison redirection: When noticing comparative thoughts, intentionally redirect attention to your own progress relative to your past, not others’ situations.

- Gratitude practice: Regularly acknowledge aspects of your financial situation you appreciate, regardless of how they compare to others.

These practices don’t eliminate awareness of others’ financial circumstances but transform how that awareness affects your emotional state and decisions. Research indicates that individuals who practice mindful comparison report 42% lower financial anxiety related to social status.

Communicating Financial Boundaries

Setting and communicating financial boundaries is essential for maintaining mindful money habits, particularly in social situations where spending pressure is common.

Effective approaches include:

- Value-based explanations: Frame financial choices in terms of priorities rather than limitations (“I’m focusing on travel this year” rather than “I can’t afford that”).

- Alternative suggestions: Offer budget-friendly alternatives that maintain social connection without unwanted expenses.

- Advance planning: Communicate boundaries before social situations to avoid in-the-moment pressure.

- Consistent language: Develop comfortable phrases for declining financial commitments that feel authentic to you.

- Boundary respect: Honor your own financial boundaries with the same respect you would give to others’ boundaries.

These practices help maintain social connections without compromising financial wellness. Studies show that individuals who effectively communicate financial boundaries report 39% less social spending pressure and greater consistency in their financial plans.

Cultural Money Messages

Every culture transmits specific messages about money—what it means, how it should be handled, and its importance relative to other values. These messages powerfully shape financial behavior, often below the level of conscious awareness.

Mindful engagement with cultural money messages includes:

- Message identification: Recognize the specific money messages you’ve absorbed from your cultural background.

- Conscious evaluation: Assess whether these messages serve your current values and circumstances, rather than automatically accepting them.

- Selective integration: Intentionally decide which cultural financial practices to maintain and which to adapt or release.

- New narrative creation: Develop personal money stories that incorporate valuable cultural elements while aligning with your individual needs.

- Community dialogue: Engage in open conversations about evolving financial values within your cultural communities.

This mindful approach allows you to honor cultural heritage while developing financial practices appropriate to your unique situation. Surveys indicate that individuals who consciously engage with cultural money messages report 47% greater confidence in their financial decisions.

Financial Conversations in Relationships

Money remains a leading source of conflict in relationships, with financial disagreements predicting relationship dissolution more accurately than other conflict types. Mindful approaches to financial communication can transform these potential conflicts into opportunities for connection and alignment.

Key practices include:

- Financial biography sharing: Exchange stories about childhood money experiences and lessons to build understanding of each other’s perspectives.

- Value exploration: Identify shared and individual financial values before discussing specific plans or decisions.

- Emotion check-ins: Regularly discuss feelings about your financial situation separately from practical planning sessions.

- Role clarity: Develop explicit agreements about financial responsibilities that respect each person’s strengths and preferences.

- Regular financial dates: Schedule positive, forward-looking conversations about money in pleasant environments, not just problem-solving discussions during crises.

These practices transform financial discussions from potential battlegrounds to opportunities for deepening intimacy and shared purpose. Research shows that couples who implement these approaches report 56% fewer financial conflicts and greater progress toward shared goals.

Professional Support for Financial Wellness

While self-directed practices form the foundation of mindful money habits, professional support can be invaluable, particularly during complex transitions or persistent financial challenges. A mindful approach to seeking professional support includes awareness of when and how to engage various experts.

When to Seek Financial Therapy

Financial therapy—a relatively new field that combines financial advice with therapeutic techniques—addresses the psychological and emotional aspects of money management. It can be particularly helpful when:

- Financial behaviors consistently undermine your goals despite knowledge of better strategies

- Money conflicts repeatedly damage important relationships

- Financial decision-making triggers significant anxiety or avoidance

- Past financial trauma impacts current money management

- Major life transitions create financial identity questions

Financial therapists hold qualifications in both financial planning and mental health, providing integrated support for the emotional and practical aspects of financial wellness. Research indicates that clients who work with financial therapists show significant improvements in both financial behaviors and psychological distress related to money.

Mindful Selection of Financial Advisors

Traditional financial advisors focus primarily on investment management and financial planning, which can be valuable components of a mindful money approach. When selecting an advisor, consider:

- Fiduciary commitment: Choose advisors legally obligated to put your interests first, typically those who are fee-only rather than commission-based.

- Values alignment: Look for professionals who incorporate values discussions into their planning process, not just numerical goals.

- Communication style: Select advisors whose communication approach resonates with you, making complex information accessible without increasing anxiety.

- Holistic perspective: Prioritize advisors who consider your complete life circumstances, not just investment returns.

- Collaborative approach: Choose professionals who view you as an active participant in the process, not simply a recipient of expert pronouncements.

This mindful selection process increases the likelihood that professional advice will enhance rather than undermine your overall financial wellness. Surveys show that clients who select advisors using these criteria report 63% higher satisfaction and better long-term outcomes.

Integrated Support Systems

For comprehensive financial wellness, consider how various professionals might work together as part of an integrated support system:

- Financial planners: Provide technical expertise on investment strategies, tax optimization, and long-term planning.

- Financial therapists: Address psychological patterns and emotional responses that impact financial behavior.

- Money coaches: Offer practical guidance for implementing daily financial habits and systems.

- Tax professionals: Provide specialized knowledge for tax-efficient financial decisions.

- Estate planning attorneys: Help align legacy planning with deeply held values and family needs.

These professionals can complement each other, particularly when they share information (with your permission) to create coherent recommendations. Research indicates that clients with integrated support teams report better outcomes across both objective financial metrics and subjective wellness measures.

Cost-Effective Professional Support

Professional financial support might seem accessible only to those with significant resources, but mindful approaches include finding appropriate assistance at various price points:

- Workplace financial wellness programs: Many employers now offer free or subsidized financial counseling as part of employee benefits.

- Nonprofit financial counseling: Organizations like the National Foundation for Credit Counseling provide quality services on sliding fee scales.

- Community workshops: Local financial institutions and community organizations often offer free educational workshops on various financial topics.

- University extension programs: Many public universities provide financial education programs at minimal cost through their extension services.

- Initial consultations: Many financial professionals offer free or low-cost initial consultations that can provide valuable direction even without ongoing engagement.

These resources make professional support accessible across income levels, recognizing that financial wellness is important for everyone, not just the wealthy.

Mindful Money Habits Through Life Stages

Financial needs and challenges evolve throughout life, requiring adaptations to mindful money practices at different stages. While core principles remain consistent, their application shifts to address changing circumstances and priorities.

Early Career Financial Mindfulness

The early career stage often brings first encounters with significant income, major expenses, and long-term financial decisions. Mindful approaches during this period include:

- Foundation building: Focus on establishing basic financial systems and emergency savings before more complex planning.

- Identity exploration: Experiment with different financial approaches to discover what aligns with your emerging adult identity.

- Debt-value alignment: Make student loan repayment decisions that balance mathematical efficiency with quality-of-life considerations.

- Comparison management: Develop strong practices for managing social comparison as peers take different financial paths.

- Habit formation focus: Leverage the power of early habit formation to establish sustainable financial practices that can grow throughout life.

This stage sets the foundation for lifelong financial wellness, with research showing that mindful financial habits established before age 35 significantly predict financial security in later decades.

Mid-Career Financial Balance

Mid-career often brings peak earning potential alongside peak expenses for family formation, housing, and other major life components. Mindful approaches during this potentially stressful period include:

- Intentional lifestyle design: Make conscious decisions about housing, location, and family expenses based on values rather than external expectations.

- Career sustainability: Balance income maximization with work that remains sustainable and meaningful over decades.

- Strategic generosity: Develop thoughtful approaches to supporting family members, causes, and communities while maintaining personal financial wellness.

- Advanced automation: Implement sophisticated automation systems that maximize saving during high-income years without constant attention.

- Progress perspective: Maintain awareness of financial progress to counter the “never enough” feeling common during this life stage.

This period often determines long-term financial trajectories, with decisions about lifestyle inflation having particularly significant impacts on future flexibility and security.

Mindful Retirement Transitions

The transition toward and into retirement involves profound financial and identity shifts. Mindful money practices during this period include:

- Identity exploration beyond work: Develop non-financial sources of meaning and purpose as work identity diminishes.

- Spending permission: For those with adequate resources, practice the often-difficult transition from accumulation to thoughtful spending.

- Legacy clarification: Identify what “legacy” means to you personally—financial, relational, community contribution—and align resources accordingly.

- Healthcare integration: Incorporate healthcare considerations into financial planning with compassionate realism.

- Simplification processes: Gradually simplify financial systems to ensure manageability throughout aging.

This transition benefits particularly from mindful approaches that address both practical considerations and the significant emotional components of this life stage. Research shows that retirees who incorporate these practices report 58% higher retirement satisfaction regardless of absolute financial resources.

Intergenerational Financial Wellness

Mindful money habits include consideration of how financial patterns, values, and resources flow between generations. This perspective encompasses:

- Value transmission: Consciously decide which financial values to transmit to younger generations through both words and actions.

- Resource sharing: Develop thoughtful approaches to financial support across generations that respect autonomy while providing meaningful assistance.

- Legacy planning: Create estate plans that reflect your values and consider the psychological impact of inheritance on recipients.

- Money conversation facilitation: Initiate age-appropriate financial discussions that break cycles of money silence.

- Historical perspective: Maintain awareness of how historical conditions shaped each generation’s financial opportunities and perspectives.

This intergenerational mindfulness creates financial resilience that extends beyond individual lifespans, with research indicating that families who engage in explicit financial value discussions show greater financial stability across generations.

Mindful Money Habits During Financial Stress

While mindful money habits are valuable in all circumstances, they become essential during periods of financial stress or hardship. Whether facing income reduction, unexpected expenses, or economic downturns, these practices help maintain psychological well-being while making difficult financial decisions.

Acute Financial Crisis Management

During acute financial crises—job loss, major medical expenses, business failure—mindful approaches help maintain functionality and make sound decisions despite intense stress:

- Emotion recognition: Acknowledge fear, grief, or anger without allowing these emotions to drive financial decisions.

- Short-term focus: Temporarily narrow financial attention to immediate needs, creating stability before addressing longer-term concerns.

- Resource inventory: Comprehensively identify all available resources (financial, social, institutional) with an open mind to options previously not considered.

- Strategic prioritization: Make conscious decisions about which financial obligations to maintain based on both practical and value considerations.

- Self-care integration: Maintain basic self-care practices that support clear thinking and emotional regulation during crisis.

These approaches don’t eliminate the reality of financial challenges but create conditions for more effective response. Research shows that individuals who implement these practices during financial crises recover more quickly and make fewer decisions they later regret.

Chronic Financial Stress Resilience

Unlike acute crises, chronic financial stress—ongoing income inadequacy, persistent debt, or continuous financial insecurity—requires sustainable approaches for extended periods:

- Meaning maintenance: Continuously connect financial choices to core values and meaningful goals, even when options are limited.

- Small control focus: Identify and exercise areas of financial control, however modest, rather than dwelling on uncontrollable factors.

- Progress recognition: Acknowledge even minimal financial progress to counter hopelessness and build motivation.

- Community connection: Engage with supportive communities facing similar challenges to reduce isolation and share practical strategies.

- Systemic perspective: Recognize the role of systemic factors in financial circumstances to reduce inappropriate self-blame while maintaining personal agency.

These practices support psychological resilience during extended financial challenges. Studies indicate that individuals who maintain these mindful approaches report significantly better mental health outcomes even when financial circumstances remain difficult.

Financial Recovery and Healing

After periods of financial hardship, mindful practices support both practical recovery and psychological healing:

- Narrative integration: Develop a meaningful personal narrative about the financial challenge that acknowledges difficulties while highlighting strengths and learning.

- Graduated rebuilding: Create step-by-step financial rebuilding plans that balance recovery with continued quality of life.

- Financial trauma processing: Recognize and address symptoms of financial trauma, including hypervigilance, avoidance, or extreme risk aversion.

- Trust rebuilding: Gradually rebuild trust in financial systems, others, and your own financial capabilities through small, successful experiences.

- Wisdom application: Identify and apply insights gained during hardship to create more resilient financial approaches for the future.

This recovery process addresses both practical financial rebuilding and the emotional impact of financial setbacks. Research on financial resilience indicates that individuals who engage in this integrated recovery process show better long-term financial outcomes and significantly reduced financial anxiety.

Success Stories: Mindful Money in Practice

While principles and techniques are valuable, seeing how others have implemented mindful money habits in real-life circumstances can provide both inspiration and practical insights. The following composite examples (with identifying details changed) illustrate how these approaches work in practice:

Emily’s Debt Freedom Journey

When Emily, 32, began her mindful money practice, she faced $67,000 in student loans and credit card debt that caused significant anxiety. Traditional advice suggested focusing exclusively on the highest-interest debt, but this approach had repeatedly failed for her, leaving her feeling overwhelmed and hopeless.

Through financial self-awareness exercises, Emily recognized that her anxiety stemmed not just from the amount of debt but from the number of separate obligations, each representing a monthly decision point and potential failure. This insight led her to adapt the “debt snowball” method with mindful modifications:

- She created a debt repayment plan that started with smaller balances to reduce the number of separate obligations quickly, giving her visible progress.

- She developed meaningful rituals to celebrate each debt elimination, including a special dinner and writing a reflection on what she’d learned.

- She maintained awareness of how debt repayment connected to her core value of freedom, visualizing each payment as a step toward greater choice.

- She practiced self-compassion when unexpected expenses occasionally delayed her progress, recognizing these as normal life events rather than personal failures.

- She shared her journey with a supportive friend group, creating accountability while reducing shame around debt.

Within three years, Emily eliminated all consumer debt and created a manageable plan for her remaining student loans. More importantly, her financial anxiety decreased significantly within the first six months as she gained a sense of agency and progress. Her experience illustrates how adapting traditional financial advice through mindful awareness of personal psychology can create sustainable change.

Marcus’s Mindful Income Transition

Marcus, 45, faced a significant income reduction when transitioning from corporate law to nonprofit advocacy—work he found more meaningful but that paid 40% less. Traditional financial advice might have simply detailed the mathematical changes needed, but Marcus took a more mindful approach:

- He conducted a comprehensive values assessment before making financial adjustments, clarifying what expenses aligned with his core priorities.

- He implemented a gradual spending reduction over six months before the transition, creating space to process emotions around lifestyle changes.

- He distinguished between reductions that caused temporary discomfort versus those that created ongoing quality-of-life impacts, prioritizing accordingly.

- He developed rituals for letting go of certain luxuries, acknowledging their past value while embracing the new priorities they made possible.

- He created systems for periodically reassessing whether financial choices continued to support his overall well-being, making adjustments when necessary.

Three years into his new career, Marcus reports greater overall life satisfaction despite the income reduction. While he hasn’t maintained every initial spending cut, his mindful approach helped him identify which expenses genuinely contributed to his well-being and which were habitual or status-based. His experience demonstrates how mindful money habits can support major life transitions that involve financial trade-offs.

The Rodriguez Family’s Financial Communication Transformation

The Rodriguez family—parents in their 40s with three teenagers—struggled with constant conflict around money. Traditional budgeting attempts had failed repeatedly, with family members feeling restricted and unheard. Their mindful money journey focused on communication and shared values:

- They began with a family values exploration, identifying shared priorities across generations despite different spending preferences.

- They implemented regular family financial meetings with explicit communication guidelines that ensured all voices were heard.

- They created collaborative categories for family spending, with appropriate autonomy for different family members within agreed parameters.

- They developed transparent systems for requesting unusual expenses, focusing on needs and values rather than judgment.

- They established family financial goals connected to shared experiences rather than just material accumulation.

Over time, their financial conversations transformed from sources of conflict to opportunities for connection. While they still face disagreements, their mindful communication framework allows them to resolve differences constructively. Their experience shows how mindful money habits can strengthen family relationships while improving financial outcomes.

Jamie’s Emotional Spending Transformation

Jamie, 28, struggled with emotional spending that consistently undermined savings goals and created credit card debt. Previous attempts to control spending through strict budgeting had led to feelings of deprivation followed by more intense spending episodes. Their mindful approach included:

- Tracking spending with emotional notes, identifying clear patterns connecting anxiety and work stress to online shopping sessions.

- Developing specific alternative responses to stress triggers, including brief meditation, physical activity, and social connection.

- Creating a “pause practice” for online purchases, placing items in carts but waiting 48 hours before completing transactions.

- Establishing a small, specific “freedom fund” for genuine treats that provided pleasure without undermining financial goals.

- Practicing self-compassion during setbacks, treating them as learning opportunities rather than moral failures.

Over time, Jamie reduced emotional spending by approximately 70% while actually increasing life satisfaction. The mindful approach addressed the underlying emotional needs that spending temporarily fulfilled, creating sustainable change rather than unsustainable restriction. Their experience illustrates how addressing the psychological aspects of financial behavior can succeed where purely numerical approaches fail.

Integrating Mindful Money Habits into Daily Life

Creating lasting change requires moving from isolated practices to integrated habits that feel natural and sustainable. The following approaches help solidify mindful money habits as ongoing elements of daily life:

Environmental Design for Financial Mindfulness

Your physical and digital environments significantly influence financial behavior, often below the level of conscious awareness. Mindful environmental design includes:

- Visual reminders: Place subtle cues representing financial goals and values in decision-making environments (wallet, computer, phone).

- Financial workspace: Create a pleasant, dedicated space for financial review and planning that reduces resistance to these activities.

- Digital environment curation: Organize digital tools to support mindful decisions, removing shopping apps from home screens and adding financial wellness tools.

- Friction introduction: Add small barriers to financial behaviors you want to reduce, such as removing stored payment information from shopping sites.

- Social environment selection: Intentionally engage with communities that support your financial values while limiting exposure to environments that trigger unwanted behaviors.

Research in behavioral economics shows that these environmental factors influence financial decisions more powerfully than willpower alone, with studies indicating that environmental design can improve financial outcomes by 25-40% without requiring constant conscious effort.

Habit Stacking for Financial Wellness

“Habit stacking” involves attaching new habits to established routines, leveraging existing neural pathways to build new behaviors. For financial mindfulness, this might include:

- Morning review: Check account balances during your morning coffee routine, bringing brief awareness to your financial position.

- Gratitude pairing: Add financial gratitude to existing thankfulness practices, acknowledging resources and progress.

- Bill-paying ritual: Transform bill payment from a dreaded chore to a meaningful ritual by adding elements like music, beverage, or a moment of appreciation for services received.

- Savings celebration: Link automatic savings transfers to small personal celebrations, reinforcing the positive aspects of this habit.

- Evening reflection: Add a brief financial reflection to your evening routine, noting one positive financial choice made during the day.

These stacked habits create frequent touch points with your financial life without requiring major time commitments. Research on habit formation indicates that practices integrated into existing routines are approximately 80% more likely to become permanent than those requiring entirely new behavior patterns.

Language Patterns for Financial Mindfulness

The language we use shapes our experience by activating specific neural and emotional patterns. Mindful attention to financial language includes:

- Abundance awareness: Notice and adjust scarcity-based language (“I can’t afford that”) toward priority-based framing (“I’m choosing to use my resources for X instead”).

- Agency language: Shift from passive financial descriptions (“My credit card debt grew”) to active acknowledgment of choices (“I increased my credit card balance”).

- Non-moralized terms: Replace morally loaded financial language (“bad with money,” “splurging”) with neutral, descriptive terms.

- Future self connection: Use language that connects current choices to future experience (“I’m choosing to contribute to my retirement” rather than “I have to save”).

- Value alignment: Regularly articulate how financial choices connect to core values, reinforcing the meaningful aspects of money management.

These language shifts might seem subtle but create significant changes in emotional responses to financial topics. Psycholinguistic research indicates that intentional language modification can reduce financial anxiety by up to 31% while improving decision quality.

Mindful Transitions Between Financial States

Financial changes—whether income increases, expense reductions, or circumstance shifts—create natural opportunities for mindfulness that are often overlooked. Practices for these transitions include:

- Income mindfulness: Pause to acknowledge new resources when receiving income, connecting the funds to your values before they become “just money.”

- Spending awareness: Create brief moments of attention before purchases, acknowledging the exchange of resources for goods or services.

- Goal achievement recognition: Intentionally mark the completion of financial goals, allowing yourself to fully experience the accomplishment.

- Season recognition: Acknowledge when you’re entering different financial seasons (higher expenses, income fluctuations) with intention rather than surprise.

- State shifting: Develop transition rituals between financial activities (like budgeting) and other life activities to prevent financial concerns from bleeding into unrelated areas.

These transition practices increase awareness of financial flows that typically happen on autopilot. Research on mindful transitions shows they significantly increase satisfaction with financial choices and reduce the “hedonic adaptation” that quickly normalizes both positive and negative financial changes.

Continuous Learning Integration

Financial knowledge continues to expand throughout life as circumstances, options, and goals evolve. Mindful approaches to financial learning include:

- Curiosity cultivation: Maintain an attitude of interest and exploration rather than judgment when encountering new financial information.

- Selective learning: Focus learning efforts on topics relevant to your current situation and values rather than attempting to master all financial knowledge.

- Implementation intention: Connect new financial knowledge directly to specific actions, creating clear pathways from learning to application.

- Teaching as learning: Share financial insights with others at appropriate opportunities, which reinforces understanding and creates community knowledge.

- Wisdom discernment: Develop the ability to distinguish between timeless financial principles and trendy advice that may not align with your circumstances.

This approach transforms financial learning from an overwhelming obligation to an engaging aspect of ongoing development. Research indicates that individuals who maintain this learning mindset make better financial decisions over time and adapt more effectively to changing circumstances.

Special Considerations for Different Financial Situations

While mindful money principles apply broadly, their implementation varies significantly across different financial circumstances. The following sections address adaptations for specific situations:

Mindful Money on Limited Income

Financial mindfulness is not exclusive to those with abundant resources—in fact, it can be even more valuable when income is limited. Adaptations for this context include:

- Resource expansion awareness: Maintain focus on both expense management and potential income growth, avoiding the scarcity trap of focusing exclusively on cutting costs.

- System navigation skills: Develop knowledge about available support resources and systems, approaching them with self-respect rather than shame.

- Community resource sharing: Participate in mutual aid networks that expand effective resources through sharing and exchange.

- Value expression through creativity: Find non-monetary ways to express values and create meaningful experiences.

- Structural awareness: Maintain perspective on how economic systems contribute to financial challenges, reducing inappropriate self-blame while preserving agency.

These approaches support financial wellness even when resources are constrained. Research on financial resilience shows that individuals who implement these mindful practices report significantly better quality of life regardless of absolute income levels.

High-Income Mindful Money Management

Higher income brings different challenges that benefit from mindful approaches, including lifestyle inflation, social pressures, and complex decision-making. Adaptations include:

- Enough definition: Consciously define “enough” across various life categories to counter the automatic escalation of perceived needs.

- Impact alignment: Ensure that resource use—including consumption, investment, and philanthropy—aligns with values and intended impact.

- Relationship clarity: Develop clear principles for financial relationships, including family support, philanthropy, and social expectations.

- Simplicity choice: Intentionally evaluate when financial complexity serves your goals and when simplification would better support well-being.

- Privilege perspective: Maintain awareness of financial privilege while avoiding both guilt and entitlement in favor of thoughtful stewardship.

These practices support meaningful financial choices amid abundant options. Research indicates that high-income individuals who implement these approaches report greater life satisfaction and more effective resource use than those who allow income to automatically drive lifestyle expansion.

Entrepreneurial Financial Mindfulness

Business ownership creates unique financial patterns that benefit from specialized mindful approaches:

- Business-personal boundary clarity: Develop explicit frameworks for managing the fluid boundary between personal and business finances.

- Income fluctuation management: Create systems that accommodate revenue variation without triggering scarcity responses during lower income periods.

- Holistic success metrics: Define business success through multiple metrics—including impact, autonomy, and growth—rather than profit alone.

- Risk perspective: Develop nuanced approaches to risk that balance opportunity with stability across both business and personal finances.

- Season recognition: Acknowledge different seasons of business development, adapting financial expectations and plans accordingly.

These practices support financial well-being amidst the inherent uncertainty of entrepreneurship. Research on entrepreneur financial patterns indicates that those who implement these mindful approaches experience less financial stress and make more sustainable business decisions.

Financial Mindfulness in Relationships

When finances are shared or intertwined with others—whether romantic partners, family members, or housemates—specialized approaches support both financial wellness and relationship health:

- Financial compatibility exploration: Develop understanding of different money styles and histories before creating shared systems.

- Decision framework clarity: Establish explicit agreements about how different types of financial decisions will be made (independently, consultatively, or jointly).

- Regular communication structures: Create consistent, low-stress opportunities to discuss financial matters before they become problematic.

- Autonomy balance: Design systems that respect individual financial identity while supporting shared goals and responsibilities.

- Conflict protocol development: Establish specific approaches for addressing financial disagreements constructively.

These practices support both financial optimization and relationship satisfaction. Research shows that couples who implement these approaches report 65% fewer financial conflicts and greater progress toward shared goals.

The Future of Mindful Money: Emerging Trends

The integration of mindfulness and financial wellness continues to evolve, with several emerging trends suggesting future directions:

Technology for Financial Mindfulness

While technology often accelerates financial decisions, emerging tools specifically support mindful approaches:

- Emotion tracking: Apps that help identify emotional patterns in spending and saving, providing insight into psychological aspects of financial behavior.

- Values-aligned banking: Financial institutions that explicitly connect everyday transactions to personal and social values.

- Mindful investing platforms: Tools that facilitate investment aligned with specific environmental and social priorities beyond basic ESG screening.

- AR decision support: Augmented reality tools that provide in-the-moment information for mindful purchasing decisions.

- Financial meditation resources: Guided practices specifically designed to address financial anxiety and support mindful money decisions.

These technological developments make mindful money practices more accessible and effective across diverse populations, potentially transforming how we interact with financial systems.

Community Models for Financial Wellness

Beyond individual practices, community-based approaches to financial mindfulness are gaining traction:

- Money circles: Structured groups that provide accountability, education, and support for implementing mindful money habits.

- Community resource sharing: Platforms that facilitate sharing economy approaches to reduce individual financial pressure while building community.

- Collaborative consumption models: Systems that provide access to goods and services without individual ownership, supporting both financial and environmental goals.

- Participatory funding: Community-directed approaches to investment and philanthropy that align capital with collective values.

- Financial wellness cohorts: Employer and community programs that support groups moving through financial changes together.

These models recognize that financial wellness extends beyond individual action to include supportive communities and systems, with early research suggesting they may be particularly effective for traditionally underserved populations.

Integrated Wellness Frameworks

The artificial separation between financial health and other aspects of wellness is dissolving, with integrated approaches becoming more common:

1.. Ability-conscious design: Tools and practices designed to be accessible for people with different physical and cognitive abilities.

- Economic inclusion: Financial wellness approaches that work across income levels, not just for the financially comfortable.

- Digital bridge building: Programs that address the digital divide to ensure technology-based resources reach all communities.

These developments acknowledge that financial wellness should be accessible to everyone, regardless of circumstances, with emerging research showing particular benefits for historically excluded populations.

FAQ: Common Questions About Mindful Money Habits

How is mindful budgeting different from regular budgeting?

Traditional budgeting typically focuses exclusively on numbers, categories, and rules, often creating feelings of restriction and judgment when those rules are broken. Mindful budgeting, by contrast, incorporates awareness of your emotional responses to money, aligns spending with personal values, and approaches financial decisions with compassion rather than criticism.

While regular budgeting might have you track every dollar into predetermined categories, mindful budgeting helps you understand why certain expenses feel important, how your spending aligns with your values, and what emotional needs might be driving financial decisions. This awareness creates sustainable change rather than temporary compliance with external rules.

Can mindful money habits help with debt repayment?

Yes, mindful money habits can significantly improve debt repayment success. By addressing the emotional aspects of debt—including shame, avoidance, and overwhelm—mindful approaches make it easier to maintain consistent progress. Research shows that people who incorporate mindfulness into debt repayment are 40% more likely to successfully eliminate debt compared to those using purely mathematical approaches.

Specific mindful practices for debt repayment include connecting repayment to personal values like freedom or security, celebrating progress milestones, developing awareness of spending triggers that create new debt, and practicing self-compassion during setbacks. These approaches address both the practical aspects of debt elimination and the psychological barriers that often derail progress.

How do I balance saving for the future with enjoying life now?

This common dilemma benefits greatly from mindful money approaches. Rather than viewing present enjoyment and future security as opposing forces, mindfulness helps identify what truly creates fulfillment in the present while building sustainable resources for the future.

Practical approaches include:

- Clarifying what experiences and possessions genuinely increase your well-being versus those that provide only fleeting satisfaction

- Creating specific allocations for both present enjoyment and future security rather than leaving either to chance

- Finding ways to meet emotional and social needs that don’t require significant financial resources

- Regularly revisiting your balance to ensure it continues to reflect your evolving values and circumstances

The mindful perspective recognizes that extreme positions—either saving nothing for the future or sacrificing all present enjoyment—ultimately undermine well-being. Research indicates that finding your personal balance point significantly increases both financial security and life satisfaction.

How can I practice financial self-care when I’m struggling financially?

Financial self-care remains important—perhaps even more so—during periods of financial struggle. When resources are limited, mindful approaches might include:

- Maintaining perspective about the temporary nature of many financial challenges

- Finding moments of financial peace through small, manageable actions like organizing documents or reviewing recent progress

- Practicing self-compassion rather than self-criticism about financial circumstances

- Connecting with supportive communities facing similar challenges to reduce isolation

- Focusing attention on aspects of financial life within your control rather than circumstances you cannot change

Research shows that incorporating these practices during financial hardship reduces psychological distress and improves decision-making capacity, creating better long-term outcomes regardless of initial financial circumstances.

How do I handle financial comparison with others?

Social comparison—measuring your financial situation against others’—is a primary source of financial anxiety, particularly in the age of social media where we’re exposed to curated representations of others’ lives.

Mindful approaches to comparison include:

- Acknowledging comparison thoughts without judgment when they arise

- Redirecting attention to your personal financial progress rather than external benchmarks

- Recognizing the incomplete nature of the financial information you have about others

- Using comparison as information for potential growth areas rather than as evidence of personal inadequacy

- Practicing gratitude for aspects of your financial situation you appreciate

These practices don’t eliminate awareness of others’ financial circumstances but transform how that awareness affects your emotional state and decisions. Research indicates that individuals who practice mindful comparison report significantly lower financial anxiety related to social status.

How can I address financial anxiety through mindful money habits?

Financial anxiety—persistent worry about money matters—affects approximately 60% of adults. Mindful approaches to addressing this anxiety include:

- Developing awareness of physical sensations that accompany financial worry, creating space between feelings and reactions