Table of Contents

Introduction

GEICO Insurance, short for Government Employees Insurance Company, is a well-known insurance provider offering various coverage options for individuals and families. This guide aims to provide a comprehensive overview of GEICO, exploring its offerings, potential savings opportunities, and helpful tips for maximizing your insurance experience.

Understanding GEICO Insurance Products

GEICO offers a wide range of insurance products, including:

- Auto insurance: This covers your vehicle in case of accidents, theft, and other damages. GEICO offers various coverage levels, from basic liability to comprehensive protection.

- Home insurance: This protects your home and belongings from fire, theft, and other covered perils. GEICO offers various dwelling and personal property coverage options.

- Motorcycle insurance: This covers your motorcycle in case of accidents, theft, and other damages. GEICO offers various coverage levels and add-ons for motorcycle enthusiasts.

- Renters insurance: This protects your belongings in your rental property from fire, theft, and other covered perils. GEICO offers various coverage options for renters.

- Personal umbrella insurance: This provides additional liability coverage beyond your primary insurance policies. GEICO offers personal umbrella insurance to protect you from high-value lawsuits.

- Unlocking Savings with GEICO Insurance.

GEICO Insurance is known for its competitive rates and various discounts that can help you save money on your insurance premiums. Here are some ways to unlock savings with GEICO:

- Get a quote online: GEICO’s website allows you to get a free quote in minutes. This helps you compare rates and coverage options before committing.

- Bundle your policies: Bundling your auto and home insurance with GEICO can lead to significant savings.

- Ask about discounts: GEICO offers various discounts, including those for good driving records, multiple vehicles, and military service.

- Consider higher deductibles: Choosing a higher deductible can lower your premium, but remember you’ll be responsible for more out-of-pocket costs in case of a claim.

- Pay your premium in full: Paying your premium in full instead of monthly installments can sometimes lead to discounts.

- Maintain a clean driving record: Avoiding accidents and traffic violations can help you qualify for lower rates.

- Additional Tips for Maximizing Your GEICO Insurance Experience

- File claims online: GEICO’s online claim filing system is convenient and efficient.

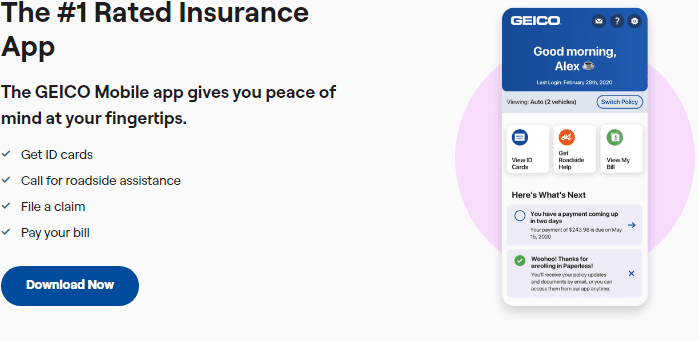

- Use the GEICO mobile app: The GEICO mobile app allows you to manage your policy, pay your bill, and access roadside assistance.

- Contact customer service: GEICO’s customer service team is available 24/7 to answer your questions and help with your insurance needs.

- Conclusion

GEICO Insurance offers a wide range of insurance products at competitive rates. By understanding its offerings, exploring available discounts, and utilizing online tools, you can unlock significant savings and maximize your insurance experience. Remember to compare quotes, ask about discounts, and maintain a clean driving record to get the best value for your insurance needs.