Introduction

In recent years, digital currencies have emerged as a groundbreaking innovation, revolutionizing the financial landscape and offering transformative opportunities for financial inclusion and empowerment. As the world becomes increasingly interconnected, the potential of digital currencies to bridge economic gaps and empower individuals cannot be overstated. This article explores the significant role of digital currencies in promoting financial inclusion and empowerment, shedding light on their benefits and potential challenges.

.jpg)

Defining Financial Inclusion and Empowerment

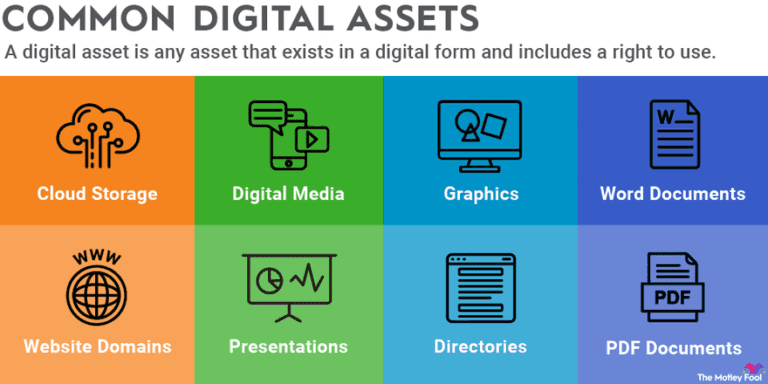

Financial inclusion refers to the access and usage of affordable financial services by individuals and businesses, regardless of their social or economic status. Empowerment, on the other hand, implies giving people the tools and resources necessary to take control of their financial well-being and make informed decisions. Digital currencies play a crucial role in achieving both financial inclusion and empowerment by eliminating barriers and democratizing access to financial services.

Breaking Down Barriers to Entry

One of the primary obstacles to financial inclusion is the lack of access to traditional banking services, especially in underdeveloped or rural areas. Digital currencies offer a decentralized and inclusive alternative, allowing individuals to participate in the financial system without the need for a traditional bank account. By using digital wallets and mobile devices, individuals can securely store, send, and receive digital currencies, thereby bypassing the need for a physical bank branch.

Lowering Transaction Costs

Traditional financial systems often impose hefty fees on even the simplest transactions, making them unaffordable for low-income individuals. Digital currencies, such as Bitcoin and Ethereum, leverage blockchain technology to enable secure and near-instantaneous transactions at significantly lower costs. This reduction in transaction costs can benefit marginalized communities and enable them to engage in economic activities that were previously prohibitive.

Enhancing Financial Security and Privacy

For individuals living in regions with political instability or unreliable financial institutions, the security and privacy offered by digital currencies can be transformative. Digital currencies operate on decentralized and cryptographically secure platforms, protecting users from potential fraud and identity theft. Additionally, the pseudonymous nature of digital currencies can offer financial privacy, empowering individuals to have greater control over their financial information.

Enabling Cross-Border Financial Inclusion

Remittances, or the transfer of money from individuals working abroad to their home countries, play a vital role in the economic stability of many developing nations. However, traditional remittance methods are often costly and time-consuming. Digital currencies facilitate cross-border transactions in a seamless and efficient manner, enabling individuals to send and receive funds internationally at a fraction of the cost and time required by traditional remittance services.

Potential Challenges and Considerations

While the potential benefits of digital currencies for financial inclusion and empowerment are significant, there are also important challenges to address. Regulatory frameworks, cybersecurity concerns, and volatility are some of the key issues that need careful consideration to ensure the sustainable and responsible integration of digital currencies into the financial ecosystem. Collaboration between governments, financial institutions, and technology providers is crucial for navigating these challenges.

Conclusion

Digital currencies have the potential to revolutionize financial inclusion and empower individuals around the world. By leveraging their decentralized nature, low transaction costs, enhanced security, and cross-border capabilities, digital currencies can bridge economic gaps and empower individuals to take control of their financial lives. However, it is essential to address the challenges and work towards developing robust regulatory frameworks that protect users while fostering innovation. With the right approach, digital currencies can play a pivotal role in building a more inclusive and empowering financial future for all.