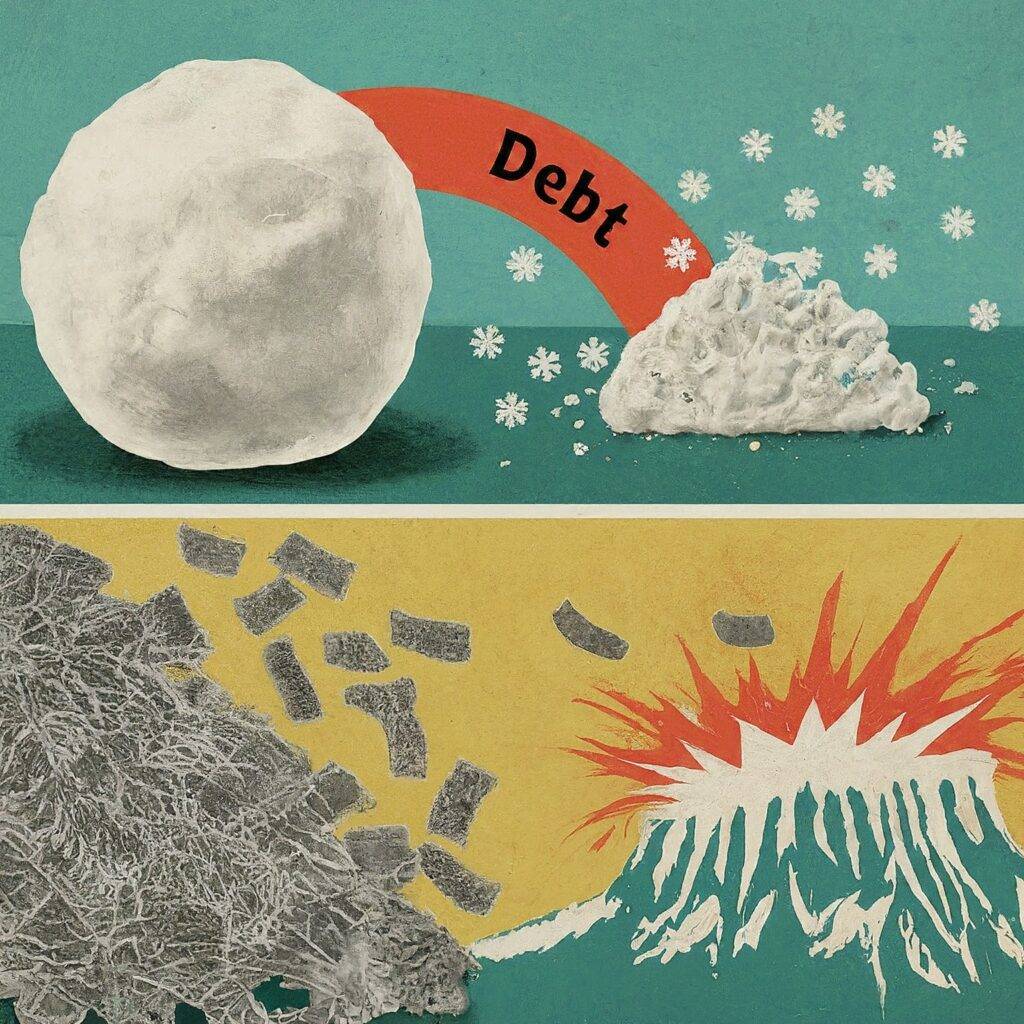

Debt – it can feel like an anchor dragging you down, a constant weight on your shoulders. But you don’t have to be a prisoner to debt! There are powerful ways to break free and achieve financial freedom. Two popular debt repayment strategies, the debt snowball and debt avalanche, offer different paths to reach your goals. Understanding the pros and cons of each will equip you to make an informed decision and choose the plan that best suits you. This article will guide you through both methods, empowering you to take control of your finances and finally conquer your debt.

The Debt Snowball: The Power of Quick Wins

The debt snowball method puts psychological motivation at the forefront of your repayment journey. Here’s how it works:

- List Your Debts: Make a complete list of all your debts, from smallest balance to largest, regardless of interest rates.

- Minimum Payments: Commit to making the minimum payment on each debt every month.

- Target & Destroy: Direct every extra penny you can muster towards the debt with the smallest balance.

- Celebrate and Repeat: Once the smallest debt is annihilated, take a moment to savor the victory. Then, take the payment you were making on that debt, add it to the minimum payment of the next smallest debt, and attack it relentlessly.

Benefits of the Debt Snowball

- Rapid Success: The thrill of watching debts disappear quickly delivers a powerful motivational boost, keeping you on track.

- Building Momentum: Success breeds success. As you accumulate small victories, your confidence grows, fueling your determination to tackle the larger debts.

- Behavioral Success: The debt snowball is especially effective for individuals who need that psychological win to stay committed to a long-term financial goal.

Drawbacks

- Potentially Higher Interest: By not prioritizing the debts with the highest interest rates, you may ultimately pay more interest over the entire repayment period.

Is the Snowball Right for You?

The debt snowball method is a stellar option if:

- You need the encouragement of rapid progress to stay motivated.

- Your overall debt isn’t overwhelming, so the potential interest difference isn’t as substantial.

- You find the mathematical approach of the debt avalanche intimidating.

The Debt Avalanche: Mathematically Savvy Debt Destruction

The debt avalanche method prioritizes logic and efficiency at the expense of quick emotional wins. Here’s how it goes:

- Target High-Interest Debts: List your debts in order of highest interest rate to lowest.

- Minimum Payments: Commit to the minimum payments on all debts.

- Ruthless Interest Attack: Focus all your extra funds on the debt with the highest interest rate.

- Rollover and Repeat: Once the highest-interest debt is demolished, take that payment, add it to the minimum payment of the next highest-interest debt, and unleash another focused attack.

Benefits of the Debt Avalanche

- Minimized Interest: Targeting the highest-interest debts first will generally save you the most money in interest payments over the life of your debt.

- Potential Speed: For those who see the numbers as motivation, the debt avalanche can potentially be a faster way to become debt-free since you’re reducing your overall interest burden aggressively.

Drawbacks of the Debt Avalanche

- Requires Patience: High-interest debts often have larger balances. It takes time and discipline to see them eliminated, which can test your motivation.

- Less Emotional Reward: If you need the thrill of quick wins, the debt avalanche might feel less satisfying initially compared to the snowball method.

Ideal Candidate for the Debt Avalanche

The debt avalanche might be the right fit if:

- Your primary goal is to save the absolute most on interest.

- You are comfortable with calculations and find motivation in the logic of the approach.

- Your willpower is strong enough to see the long game.

Example: Debtor Profile

Let’s imagine a person named Sarah with the following debts:

- Credit Card 1: $3,500 balance, 18% interest rate

- Student Loan: $12,000 balance, 6% interest rate

- Credit Card 2: $1,800 balance, 21% interest rate

Example: Debt Snowball

- Step 1: Sarah lists her debts from smallest balance to largest, regardless of interest rate.

- Step 2: She continues paying the minimum payment on all debts but focuses extra money on Credit Card 2 (the smallest balance). Let’s say she can direct an extra $200 per month.

- Step 3: In 9 months, Credit Card 2 is paid off! Now that $200, plus the former minimum payment on Credit Card 2, is rolled over onto Credit Card 1.

- Step 4: This process continues until Sarah becomes debt-free.

Example: Debt Avalanche

- Step 1: Sarah lists her debts in order of highest to lowest interest rate.

- Step 2: She focuses her extra $200 monthly payment on Credit Card 2 (the highest interest debt).

- Step 3: Once Credit Card 2 is eliminated, she rolls the payment over to the student loan (now the debt with the highest interest rate).

- Step 4: This continues until she’s debt-free.

Scenario 1: Need for Quick Motivation

Sarah is feeling overwhelmed and demotivated by the size of her debt. The debt snowball method might be the ideal choice as she’ll quickly eliminate her smallest balance, providing a psychological victory that encourages her to keep going.

Scenario 2: Focus on Saving Money

Sarah is analytical and wants to minimize interest paid over time. The avalanche method makes mathematical sense in this case, as paying down high-interest debt first reduces the overall burden.

Important Note in the Article:

Emphasize that these examples assume consistent payments and interest rates. Real-life scenarios might be impacted by fluctuating interest rates or life events impacting Sarah’s available income.

The Bottom Line on Debt Repayment

Success with the debt avalanche ultimately depends on your commitment level. If you find yourself wavering when progress seems slow, it might be worth reassessing your strategy. Remember, tackling your debt using any method is an achievement to be celebrated!

Debt Management Made Easy: Budgeting Apps to the Rescue

When you’re battling debt, feeling overwhelmed and disorganized can become your worst enemies. Budgeting and debt management apps can become your powerful allies, bringing structure and clarity to the fight. Here’s a breakdown of how they make the journey towards debt freedom much easier:

Core Features of Debt Management Apps

- Centralized Debt Tracking: Tired of juggling multiple account statements? These apps consolidate all of your debt information into one easy-to-view dashboard. See your balances, interest rates, and due dates in a single snapshot.

- Automated Payments: Forgetfulness can be costly when it comes to debt. Apps can automate payments, ensuring they’re made on time, every time. This helps protect your credit score and avoids those pesky late fees.

- Visualizing Your Progress: Sometimes, all you need is a visual aid! Debt management apps often use colorful charts, graphs, and progress bars to show you how much you’ve paid down and exactly how much further you have to go. This visual representation is a fantastic motivational tool.

- Milestone Celebrations: Did you just eliminate a smaller debt? Some apps gamify the experience by offering celebratory reminders and virtual rewards. This might seem small, but those little ‘wins’ are essential for keeping your spirits high.

- Personalized Insights and Budgeting: Many debt management apps integrate seamlessly with your bank accounts. This allows for automatic expense tracking and can offer tailored insights into where your money is going. Effective budgeting is crucial for freeing up money to aggressively attack your debt.

Popular Debt Management Apps

While there are many to choose from, reputable debt management and budgeting apps include:

- You Need a Budget (YNAB): Focuses on in-depth budgeting and “giving every dollar a job”.

- Mint: Popular and free, it’s great for beginners, offering overall financial tracking.

- Undebt.it: Helps you create a customized debt payoff plan, choosing either snowball or avalanche methods.

- Tally: Offers a line of credit specifically designed for consolidating higher-interest credit card debt.

Important Note: Remember, these apps are tools that streamline your effort. Success still depends on your determination and smart spending habits!

Tips for Maximizing Your Debt Management Strategy

While choosing a debt repayment method (like the snowball or avalanche) is essential, your success greatly depends on maximizing the effectiveness of your overall strategy. Here’s how to supercharge those efforts:

- Create a Detailed Budget: The Foundation of Debt Elimination

- True Picture: A budget isn’t about restriction, it’s about awareness. Honestly track every single expense to get a truly accurate picture of your spending habits.

- Freeing Up Funds: Once you see where your money goes, you can spot areas for smart cuts. These ‘found’ funds get redirected aggressively towards debt repayment.

- Types of Budgets: Explore different budgeting methods (like Zero-Based Budgeting or the 50/30/20 rule) to see which works best for you.

- Boost Your Income: Accelerate Your Progress

- Side Hustles: Even a small side gig like freelance work or online surveys can make a difference. Dedicate all extra income straight to debt repayment.

- Temporary Solutions: While building long-term income streams is ideal, short-term solutions like selling unused items can provide a quick cash infusion for your debt attack.

- Negotiate Interest Rates: The Power of Asking

- It Doesn’t Hurt to Try: Contact your creditors (especially on credit cards) and explain your commitment to paying down the debt. Ask them for a reduced interest rate.

- Success Stories: Many people are pleasantly surprised by how often companies are willing to work with them. Every percentage point reduction in interest saves you money long-term.

- Avoid Taking on New Debt: Don’t Self-Sabotage

- Mindset Shift: Unless facing a true emergency, put all non-essential spending on hold. This means resisting tempting sales and financing offers.

- Break the Cycle: If you pay off debt while simultaneously adding new debt, you’re running on a treadmill. Break this cycle to finally make headway.

- Celebrate Your Wins: Maintain Your Momentum

- Acknowledgement is Key: Paying down debt is hard work! Take the time to properly acknowledge milestones, regardless of their size.

- Fueling Your Fire: Celebrating progress renews your motivation, especially if you pair it with a tangible reward (not something that creates new debt, of course!)

Additional Notes:

- Don’t Be Afraid to Ask for Help: If you feel overwhelmed, credit counselors and financial advisors can offer tailored strategies and support.

- Every Little Bit Counts: Even if you can only add an extra $20 a month toward your debt, it makes a difference over time!

Say Goodbye to Crushing Interest Rates and Hello to Financial Freedom

If you’ve been trapped in a cycle of debt, especially with high-interest rates, the weight can feel unbearable. The good news is, breaking free isn’t just possible, it’s incredibly empowering. Here’s what you can look forward to as you crush those interest rates and work towards a debt-free life:

- Less Stress, More Peace: Worrying about debt is a constant source of anxiety. As you chip away at the balances, that mental burden will lift, improving your overall well-being.

- Reclaimed Money: Imagine all the money going towards interest payments suddenly being yours to use. That could be extra savings, a fulfilling vacation, or investments in your future.

- Improved Credit Score: High debt utilization hurts your credit score. As you improve this ratio, you’ll gain access to better interest rates and financial opportunities should you need them.

- Building Your Future: Being debt-free isn’t just about living without payments; it’s about gaining the ability to build the life you want. Reach those long-term goals like homeownership or starting a business.

- Confidence Boost: Achieving any major goal builds confidence. Imagine the pride you’ll feel as you conquer your debt, knowing you can tackle any financial challenge.

The Journey is Empowering

The road to financial freedom won’t always be easy, but remember:

- You’re Not Alone: Countless people have successfully escaped debt. Seek out resources and communities for support.

- Start Today: The sooner you take action, the quicker you’ll reach your goals. Even small steps are progress.

- The Ripple Effect: As you conquer your debt, you’ll likely inspire others around you to take control of their finances.