How to Actually Make Money with AdSense in 2026 (Beginner-Friendly Tips)

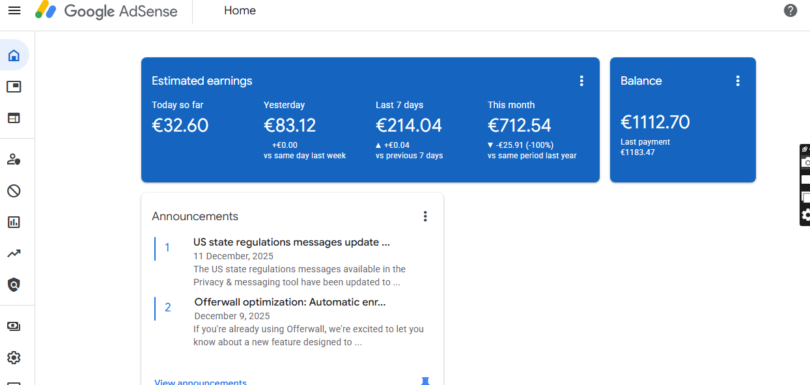

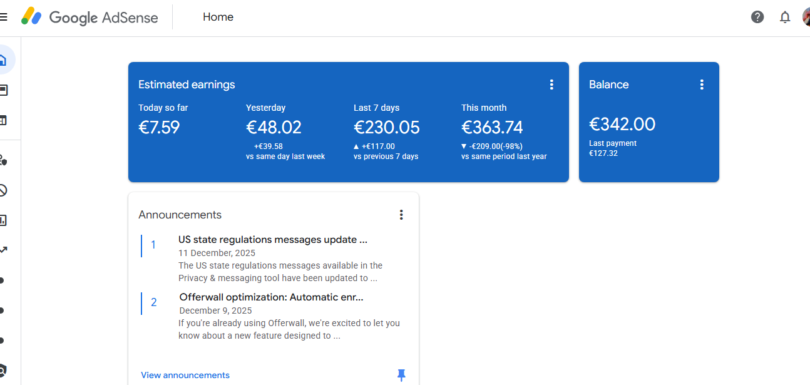

Hey there! You finally got the AdSense approval email — that little green “Approved” notification that makes your heart skip a beat. You log in, paste the code into your site, refresh the page… and the first month’s earnings are $1.23. Sound familiar? I’ve been exactly there. Most new bloggers have. That tiny number staring […]