Introduction

Table of Contents

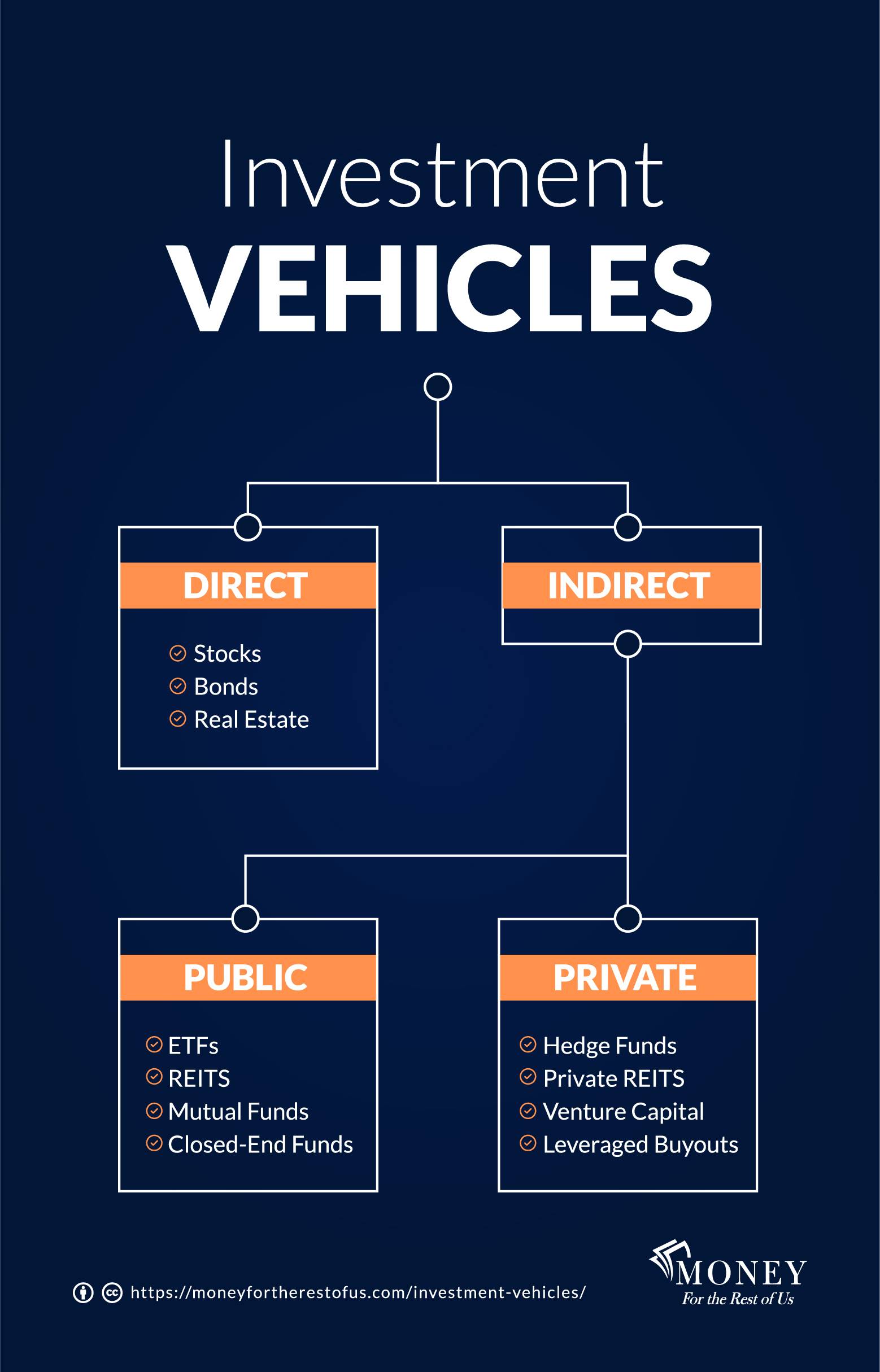

In today’s dynamic financial landscape, investors have an array of investment vehicles at their disposal to grow their wealth and secure their financial future. From traditional options like stocks and bonds to more modern choices like cryptocurrencies and real estate, each investment vehicle comes with its unique set of advantages and disadvantages. In this article, we will explore the pros and cons of different investment vehicles, equipping you with the knowledge needed to make informed investment decisions.

Investment Vehicles Stocks

Pros:

- Potential for High Returns: Historically, stocks have offered some of the highest returns among investment options, allowing investors to build wealth over time.

- Liquidity: Stocks are highly liquid assets, meaning you can quickly convert them to cash when needed, offering flexibility in managing your Investment Vehicles.

- Diversification: By investing in a diverse range of stocks, investors can spread their risk and reduce exposure to any single company or industry.

Cons:

- Volatility: The stock market can experience significant fluctuations, leading to short-term losses, which may test investors’ emotional resilience.

- Market Risks: Economic downturns and unforeseen events can impact stock prices, making them vulnerable to market risks.

- Bonds

Pros:

- Stability: Bonds are considered more stable than stocks, making them a reliable source of income for risk-averse investors.

- Fixed Income: Bonds provide regular interest payments, ensuring a predictable income stream for investors.

- Capital Preservation: In times of market turbulence, bonds tend to offer a safer haven for capital preservation.

Cons:

- Lower Returns: Compared to stocks, bonds generally offer lower returns, which may not keep pace with inflation.

- Interest Rate Risk: When interest rates rise, bond prices can fall, potentially affecting the overall value of the Investment Vehicles.

- Real Estate

Pros:

- Tangible Asset: Real estate provides investors with a physical, tangible asset that holds intrinsic value.

- Rental Income: Owning rental properties can generate a steady stream of rental income, offering a source of passive cash flow.

- Hedge Against Inflation: Real estate values often appreciate over time, acting as a hedge against inflation.

Cons:

- Illiquidity: Real estate investments can be challenging to liquidate quickly, tying up capital for extended periods.

- Maintenance and Management: Owning and managing real estate properties require time, effort, and additional expenses for maintenance.

- Mutual Funds

Pros:

- Professional Management: Mutual funds are managed by professional fund managers, reducing the need for individual research and decision-making.

- Diversification: Mutual funds invest in a portfolio of assets, spreading risk across various holdings.

- Accessibility: Mutual funds are relatively easy to buy and sell, providing investors with liquidity.

Cons:

- Fees and Expenses: Some mutual funds charge management fees and expenses, which can eat into overall returns.

- No Control Over Holdings: Investors have little control over the individual assets held within the mutual fund.

- Cryptocurrencies

Pros:

- High Growth Potential: Cryptocurrencies have shown rapid growth in recent years, attracting investors seeking high returns.

- Decentralization: Cryptocurrencies operate on blockchain technology, providing a decentralized and secure transaction platform.

- Portfolio Diversification: Adding cryptocurrencies to an investment portfolio can enhance diversification.

Cons:

- Volatility: Cryptocurrencies are highly volatile, subject to extreme price fluctuations within short periods.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies can impact their adoption and value.

Conclusion

Each investment vehicle comes with its own set of advantages and disadvantages. Understanding the pros and cons of various investment options is crucial for making well-informed financial decisions. As an investor, it is essential to assess your risk tolerance, financial goals, and time horizon before allocating your funds across different investment vehicles. Diversification, combining various assets in a balanced manner, can be a prudent approach to managing risk while aiming for long-term growth. Remember, seeking advice from a financial advisor can further aid you in creating a tailored investment strategy aligned with your unique financial circumstances.